South Korean Survey: 80% See Cryptocurrency as Gambling, Fear Rug-Pulls and Price Manipulation

- An South Korean survey conducted by Segye Ilbo and Embrain found that 80% of respondents consider cryptocurrency as a form of “gambling.”

- Over half of those who equated crypto investment with gambling did so because they felt most tokens lacked real-world assets backing.

A recent survey conducted in South Korea by Segye Ilbo and Embrain has shed light on the perception of cryptocurrency among citizens. The survey, which questioned 1,000 respondents nationwide from August 3 to August 8, uncovered several key insights into South Koreans’ views on crypto.

The most striking finding was that a significant 80% of respondents considered cryptocurrency to be a form of “gambling.” Among those who held this view, 53.2% believed it was because most tokens lacked real-world assets backing them. About one in five respondents expressed concerns about rug-pulls, while 16% cited worries about price manipulation. Only 5% were anxious about coins being subject to “weak regulation by financial authorities,” and less than 2% were concerned about hacking-related risks.

Despite the prevalence of cryptocurrency trading, the survey revealed that only about 6% of respondents who invested in crypto claimed to have a good understanding of blockchain technology. The majority had “some understanding” of the technology, and over 3% admitted to buying crypto “with no knowledge at all” about blockchain.

The survey also reflected public sentiment regarding public officials’ involvement in cryptocurrency. A significant 76% of respondents believed it was “inappropriate” for public officials to invest in crypto, likely influenced by the ongoing Coin Gate scandal. Confidence may have further eroded due to domestic price manipulation controversies.

Gender and Age Disparities in Crypto Investment

The data highlighted that cryptocurrency investment in South Korea remains predominantly male-dominated. More than half of men in their 20s and 30s reported having traded crypto. While one in five purchased crypto as part of their long-term investment portfolios, six in ten did so for “fun” or with the aim of making “short-term profits.”

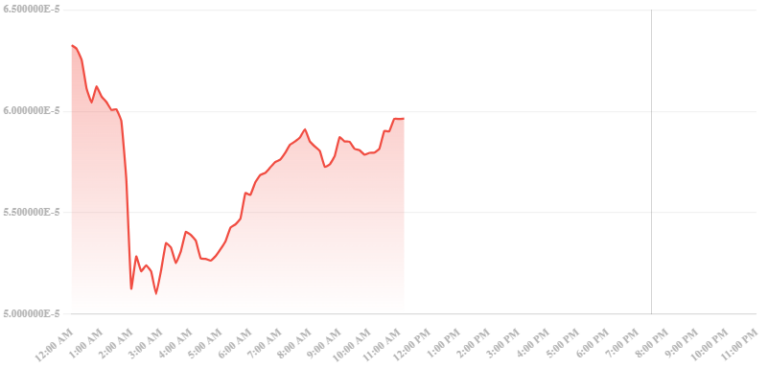

Respondents were asked about their predictions for Bitcoin’s market performance in 2024. Most anticipated stagnant prices, but a notable 21.3% expected an increase.