Ripple Labs Slams SEC Amidst Regulatory Upheaval: The ‘Summer of Justice’ Unfolds

- Ripple Labs’ CEO and Chief Legal Officer criticize the SEC’s regulatory stance.

- Ripple’s recent legal victory adds to the ongoing regulatory uncertainty affecting major cryptocurrencies.

In a crypto landscape marked by elusive regulatory clarity, Ripple Labs’ CEO, Brad Garlinghouse, and Chief Legal Officer, Stuart Alderoty, have seized the moment to publicly rebuke the U.S. Securities and Exchange Commission (SEC). Their critique follows a significant court victory for Grayscale Investments, forcing the SEC to reevaluate its stance on Grayscale’s Bitcoin ETF application.

Stuart Alderoty wasted no time in taking to social media to describe the SEC as “being battered in court.” He highlighted not only the SEC’s recent courtroom setbacks but also its alleged hypocrisy and disregard for legal standards. Alderoty also emphasized the SEC’s “discovery abuses,” a matter for which the Commission was penalized.

In parallel, Brad Garlinghouse voiced his perspective on what he termed a “Summer of Justice.” He cited a series of legal victories against the SEC and criticized what he sees as the SEC’s erroneous approach to law and facts.

Despite Ripple’s enduring legal standoff with the SEC, now spanning over two years, the company secured a notable victory when a New York judge issued a summary judgment in Ripple’s favor. However, the SEC has signaled its intent to appeal certain aspects of that decision.

Ripple’s leadership has consistently criticized the SEC for its approach to crypto-assets, asserting that the regulatory body prioritizes punitive enforcement actions over the establishment of clear, rational legal guidelines.

Market Implications and Technical Analysis

It is important to note that this ongoing legal and rhetorical battle creates an environment of uncertainty that reverberates across the cryptocurrency market, impacting investor sentiment in major cryptocurrencies, including XRP, Bitcoin (BTC), and Ethereum (ETH).

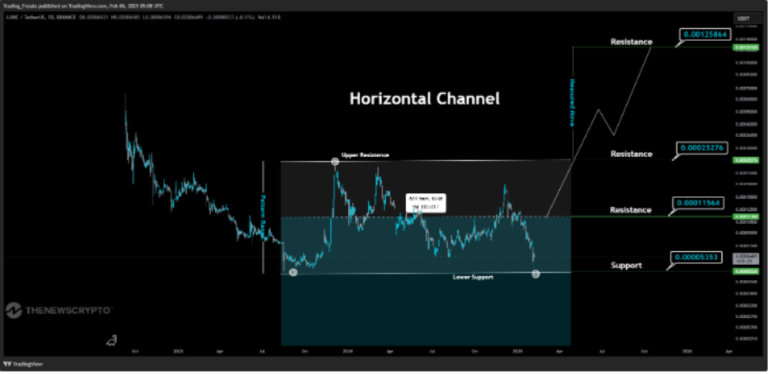

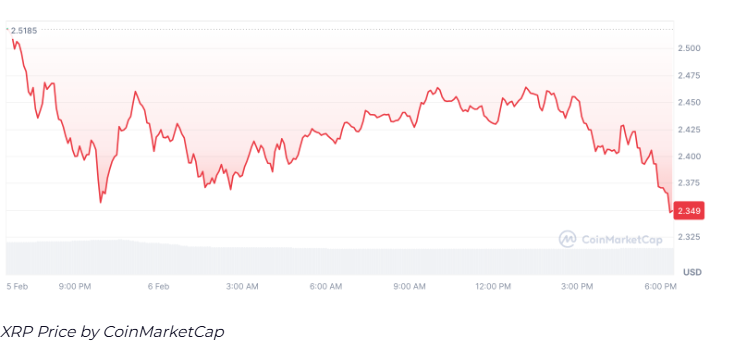

XRP, after a breakout from a symmetrical triangle pattern, is currently resting near the 50 SMA (Simple Moving Average). A successful hold at this level could empower bullish investors to target pivotal resistance at $0.545 and potentially reach the 200 SMA around $0.61.

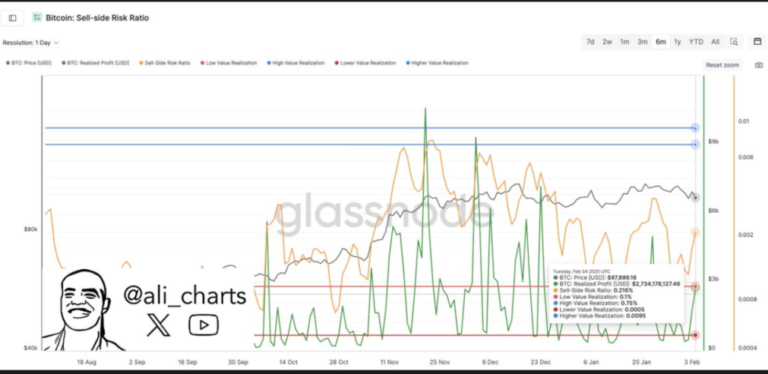

Bitcoin has also broken out of its five-day trading range, backed by substantial trading volumes, setting the stage for potential gains targeting the $28,000 to $29,000 resistance zone.

Ethereum’s price, within a symmetrical triangle pattern, indicates a bullish trajectory with above-average trading volumes. Key resistance levels to monitor include $1,757 and $1,820, provided Ethereum maintains its position above the 50 SMA.

The ongoing interplay between legal and market factors continues to shape the cryptocurrency landscape, with Ripple and the SEC emerging as prominent figures in this evolving narrative.