October Could Be the Best Month for Bitcoin Holders, This is Why

- A new Bloomberg report states that Bitcoin enthusiasts are in hope that the king of crypto will revert and form in the month of October as BTC expected to surge up by roughly 25%

- According to Glassnode, long term BTC holders continue to have a firm grip of their assets as they await another leg lower in markets

The year 2022 has seen Bitcoin traders in jeopardy since the winter season commenced. Focusing on the last two months, the crypto gladiator has seen a major drop with BTC barely cruising just below the $20,000 mark. The latest Feds meeting has seen BTC’s price surfing further below with the announcement of Fed’s interest rate being raised by 75 basis points also impacting the market.

Despite the non-ending bearish trend, October seems to be in favor of the largest cryptocurrency by marketcap as the coin has been recording green bars since. Citing data from the trend, a new Bloomberg report states that Bitcoin’s enthusiasts are in hope that the king of crypto will revert and form in the month of October.

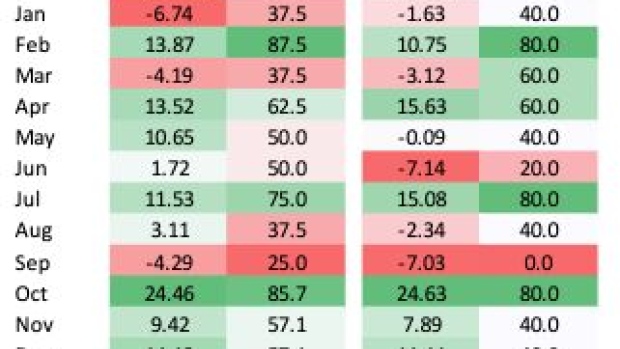

According to Bespoke iinvestment group, Bitcoin is expected to surge up by roughly 25% in the month of October and has, since 2015, advanced more than 85% of the time during it. Jake Gordon of Bespoke noted;

“For the average monthly moves, October ranks as the best for Bitcoin,”

Bitcoin made it to October in style with the currency adding on as much as 1.3% to $19,492 on Monday. It is also notable that the King of crypto is stealing back its show when it comes to total market supply. With a total market share of 48$, the third highest after its last high of 70% hit back in early September 2019.

Bitcoin investors can now breathe a sigh of relief as October has shown a beacon of hope after a rough ride. August saw BTC’s price down by 15% followed by a 4% downtrend in the following month. The currencies price has been in the similar roller coaster with US stocks, which have been choppy as a result of the Federal Reserve’s objective of tamping down red-hot inflation.

According to Glassnode, long term BTC holders continue to have a firm grip of their assets as they await another leg lower in markets, meanwhile, retail investors are still in the sidelines, with analysts having it that retailers might wait till prices start recovering.

In terms of the second largest cryptocurrency, ETH seems to be headed in the right direction since it hit a low of $1272 two days ago. At the time of writing, the coin has recorded a 3.87% gain the last 7 days with it surfing at the $41345.65 mark.

+ There are no comments

Add yours