Data Shows Institutional Investors Taking Over From Retailers in the DeFi Space

- The latest data shows that in the last year, institutional investors have accounted for over 60% of all DeFi transactions in Q2 2021, up from around 10 percent in Q3 2020.

- Recent surveys have further shown that even those not involved are excited about the space and intend to get involved in the short or long term.

Since the inception of Decentralised finance (DeFi), it has largely been spearheaded by retail investors and products. The space offers retailers a chance to access financial tools without having to seek the services of traditional financial institutions. Institutional investors, at first skeptical, but the latest reports show a change in approach from the movers and shakers.

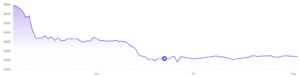

According to blockchain data provider Amberdata, DeFi transactions grew from $601m at the beginning of 2020 to $239bn in 2022. Additional data from Chainanalysis has shown that institutional investors (above $10M) accounted for around 60% of the total transactions in the DeFi space as of Q2 of 2021. More recent data shows that the total value locked – the overall value of assets deposited in DeFi transactions grew from $601m at the beginning of 2020 to $239bn in 2022.

At the time of press, the total value locked (TVL) stands at just over $40 billion.

Institutional Concerns about DeFi

In the past, Institutional investors have raised a number of concerns with DeFi, these include a lack of investor protection, risk of theft by hackers, and the loss of private keys among others. While these concerns persist even among retail investors, innovation has continued to lure all.

The new trend is likely to see DeFi platforms begin to take focus and create more institutionally focused products. Ethereum remains the leader in space. In recent times, other competing platforms have sprung up and are eating up Ethereum’s share. Uniswap, SushiSwap, Aave, and Curve Finance are some of the upcoming platforms that leading the space.

+ There are no comments

Add yours