Solana (SOL), Dogecoin (DOGE), and Aptos (APT) Face Critical Market Crossroads Amidst Bearish Sentiment

- Solana (SOL) recently experienced a notable pullback from its peak at $32.13 to a low of $17.36 on September 11th, testing a crucial 256-day ascending support line.

- The Relative Strength Index (RSI) indicates a bearish sentiment for SOL, with a potential 20% decline to $14 if it breaks its support, or a 50% surge to $27 if it holds.

Solana (SOL) has experienced significant price fluctuations, dropping from its peak at $32.13 in mid-July to $17.36 on September 11th. This pullback has led to a critical test of the 256-day ascending support line, a key metric for assessing market strength. The Relative Strength Index (RSI) indicates a bearish sentiment, suggesting a potential 20% decline to $14 if SOL breaks its support. However, if it holds, there’s potential for a 50% surge to $27, offering a glimmer of hope for bullish investors.

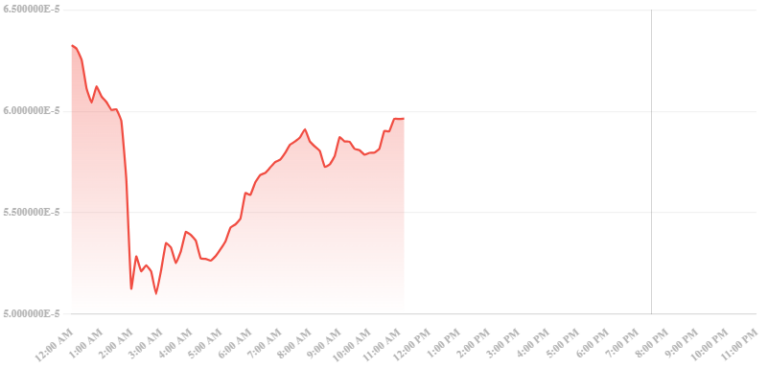

Dogecoin (DOGE) faced a setback after an ascending support line, dropping to $0.055 and then rebounding to $0.060 with resistance at $0.066. The RSI also indicates a bearish undertone, hinting at a possible 12% decline to $0.053 if DOGE loses its grip on the $0.060 support. Conversely, a resurgence of bullish momentum could propel DOGE toward the 0.5 Fibonacci level at $0.070, signaling a more positive trajectory.

Aptos (APT) Nears Critical Low

Aptos (APT) has experienced a substantial decline from its peak at $20.40, finding temporary support at $5.40 in June before briefly reclaiming $5.80. However, bearish pressures in September have dimmed prospects. The RSI for APT doesn’t offer much optimism, indicating a potential 35% dip to $3.30 if bearish trends persist. A bullish interruption, on the other hand, might see APT challenging the $5.80 level, which now acts as a resistance.

While FTX’s structured asset liquidation may provide some market stability, Solana (SOL), Dogecoin (DOGE), and Aptos (APT) remain at pivotal points in their respective market journeys, with RSI indicators signaling potential shifts that could impact their future trajectories.