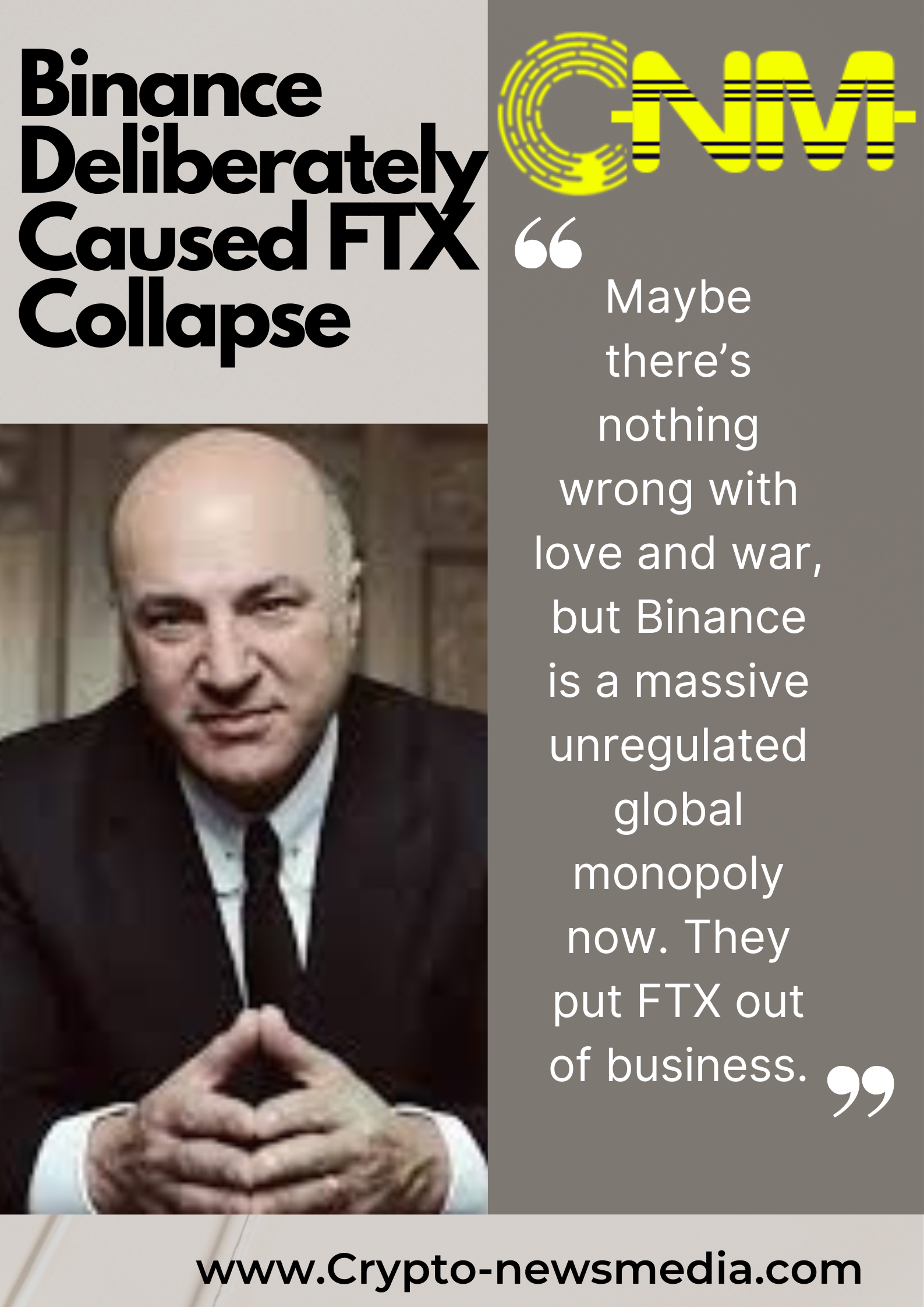

Here’s Why Kevin O’Leary, Shark Tank Star Thinks Binance is Behind FTX Collapse

- O’Leary says Binance founder Changpeng Zhao deliberately caused the collapse of Bahamas-based cryptocurrency exchange FTX.

- The television star invested in FTX and has said he was paid US$15 million to be a spokesperson for the company.

The comments of Kevin O’Leary, chairman of venture capital firm O’Leary Ventures and star of TV’s Shark Tank were part of a Senate Committee on Banking, Housing and Urban Affairs hearing on Wednesday titled: “Crypto Crash: ‘Why the FTX Bubble Burst and the Harm to Consumers.’

This is despite FTX’s new chief executive John Ray telling the committee on Tuesday that Binance had nothing to do with the exchange’s collapse.

Related: SHARK TANK STAR KEVIN O’LEARY, LOSES $15M AS FTX SPOKESPERSON

The Canadian businessman invested in FTX and has said he was paid US$15 million to be a spokesperson for the company. The Canadian influencer labeled Sam-Bankman Fried a good businessman and in case of any other opportunities, he would not hesitate to have the disgraced crypto mogul on his team. On the same premise, he says in the interview that “I have an opinion, not the records. One put the other out of business intentionally.”

O’Leary also claimed that he questioned Bankman-Fried about the usage of customer funds in the last two years and was informed that about $3 billion was utilized to repurchase Binance-owned FTX shares.

However, Mr. Ray, a lawyer, and insolvency specialist who oversaw Enron’s bankruptcy said that FTX was not solvent and Binance did not cause its collapse.

In early November, Changpeng Zhao, Binance CEO, the world’s biggest cryptocurrency exchange, tweeted that Binance was selling the exchange’s holdings of FTX native token, liquidating its FTT position, a move that contributed to a run on FTX and its eventual bankruptcy that trashed the crypto market including several other exchanges feeling the domino effect and exposure to the behemoth.

Kevin O´Leary wants to do it and sees Binance responsibility, not billions of stolen assets pic.twitter.com/kAVJZd31YP

— smartmate (@gernot_lechner) December 14, 2022

Mr.Wonderful wasn’t hesitant to give his theory explaining why FTX went for the ruins last month, which sounded oddly similar to SBF’s, but steered clear of the alleged deceptive business methodologies and misappropriation of billions of dollars in client funds that resulted in eight federal criminal charges against the former CEO this week .

Bankman-Fried was indicted in New York federal court for conspiracy to commit wire fraud on customers, wire fraud on customers, conspiracy to commit wire fraud on lenders, wire fraud on lenders, conspiracy to commit commodities fraud, conspiracy to commit securities fraud, and conspiracy to commit money laundering.

+ There are no comments

Add yours