Macro Expert Raoul Pal Outlines Three Scenarios Shaping Bitcoin’s Future

- Raoul Pal, former Goldman Sachs executive and CEO of Real Vision, outlines three scenarios for Bitcoin’s future.

- The most likely scenario (60% chance) is a traditional bull run, with Bitcoin potentially reaching $100,000 to $200,000.

Macro expert and former Goldman Sachs executive Raoul Pal, currently the CEO of Real Vision, has unveiled three compelling scenarios that could significantly influence the future of Bitcoin (BTC).

Scenario 1: Traditional Bull Run (60% Chance)

Pal considers the most probable scenario to be a traditional market cycle, with a 60% likelihood. In this scenario, Bitcoin could experience a substantial rally, potentially reaching heights between $100,000 and $200,000. This aligns with historical patterns and the expectations set by previous bull markets. It suggests that Bitcoin, along with other digital assets, would continue to increase in value, reflecting their respective risk profiles.

Scenario 2: Massive Capital Influx (20% Probability)

The second scenario, assigned a 20% probability, envisions an unexpected and massive influx of capital into the digital assets industry. Such an influx could trigger a bull run that surpasses current expectations, leading to “EXCESS RETURNS BEYOND EXPECTATIONS.” This scenario indicates a significant shift in market dynamics, possibly driven by broader adoption and increased institutional and retail investment.

Scenario 3: Shorter, More Intense Cycle (20% Probability)

The third scenario Pal outlines involves a market cycle that is front-loaded and shorter than previous cycles but significantly more intense. This outlook implies a rapid and sharp market movement, contrasting with the gradual trends observed in previous cycles.

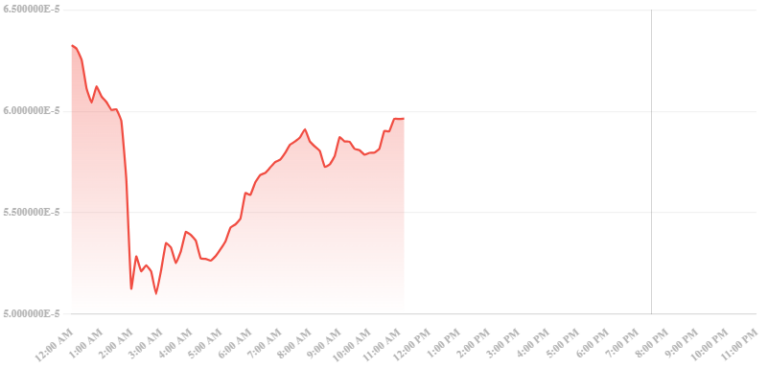

As of the present moment, Bitcoin is trading at $44,279, reflecting a 2.73% increase over the past 24 hours. This current market behavior sets the stage for Pal’s scenarios, providing valuable insights into Bitcoin’s volatility and its potential for significant price movements.

Pal’s predictions, grounded in his extensive background in macroeconomics and finance, offer valuable perspectives for cryptocurrency investors and enthusiasts. As the crypto market continues to evolve, these scenarios present various possibilities for Bitcoin’s trajectory, emphasizing the unpredictable and dynamic nature of the digital asset market.