- The launch of EURØP and USDB stablecoins on the XRP Ledger is boosting liquidity and expanding real-world use cases across Europe and Latin America.

- As XRP consolidates near key resistance, technical indicators suggest a potential breakout toward the $2.80–$3.00 range.

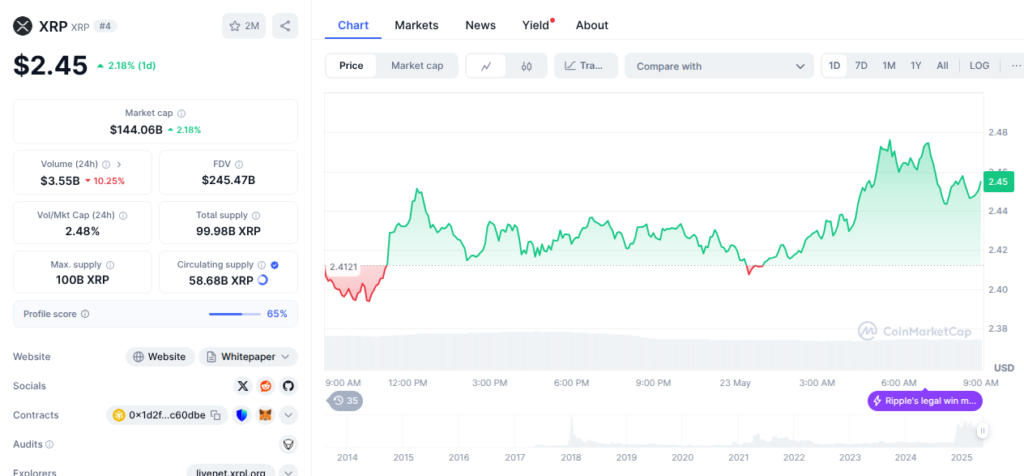

XRP is making headlines again. Trading at $2.45 with a 2% daily gain, XRP is showing renewed strength as two fully backed stablecoins—EURØP and USDB—make their debut on the XRP Ledger (XRPL). These launches mark a pivotal moment in Ripple’s strategy to transform XRPL into a compliance-ready, high-liquidity blockchain hub for global finance.

Schuman Financial’s EURØP Brings Euro-Backed Stability to XRPL

On May 22, Ripple announced the launch of EURØP, a euro-denominated stablecoin issued by Paris-based Schuman Financial. Fully compliant with the European Union’s Markets in Crypto-Assets Regulation (MiCA), EURØP is backed by reserves held at major financial institutions like Société Générale and undergoes routine audits by KPMG.

Martin Bruncko, CEO of Schuman, hailed the move as “the next wave of financial innovation happening on-chain,” highlighting XRPL’s established track record of over 3.3 billion transactions secured by more than 200 validators. EURØP aims to support tokenized assets, B2B transfers, and international business payments—areas where stablecoins can dramatically streamline costs and improve transaction speeds.

Also read: Shiba Inu Burn Rate Jumps 8,925% – Will SHIB Price Surge to $0.0000153 Without Whale Support?

Brazil’s Braza Group Launches USDB to Power Cross-Border Transactions

In tandem with EURØP, Brazil’s Braza Group introduced its dollar-pegged USDB stablecoin, tailored for both institutional finance and everyday users. Backed by U.S. and Brazilian government bonds, USDB is audited regularly and designed for seamless remittances and commercial transactions via Braza’s mobile app.

Marcelo Sacomori, Braza’s CEO, believes stablecoins like USDB will “eventually surpass traditional foreign exchange markets” and sees XRPL as a foundational layer for this transition. With $1 billion in daily interbank transactions and over 15 years in Brazil’s financial sector, Braza is aiming for a 30% market share in Brazil’s USD stablecoin market by 2025.

Technical Analysis: XRP Poised for Potential Breakout

From a technical standpoint, XRP is consolidating near the $2.47 level, with resistance at $2.58. The RSI sits neutrally at 59, offering room for further upside before signaling overbought conditions. The 10- and 20-day moving averages—both simple and exponential—are sloping upward, reinforcing a bullish trend.

If bulls can clear the $2.58 resistance, XRP could surge toward $2.80, with a potential retest of the psychological $3.00 level. Failure to break out may lead to a pullback to $2.30 or even $2.16, where the 50-day moving averages provide strong support.

The launch of EURØP and USDB on XRPL is more than just a technical upgrade—it represents a broader shift toward real-world adoption of blockchain-based finance. With XRP gaining momentum and stablecoin liquidity deepening, all eyes are now on whether XRP can break through resistance and lead the next wave of crypto innovation.