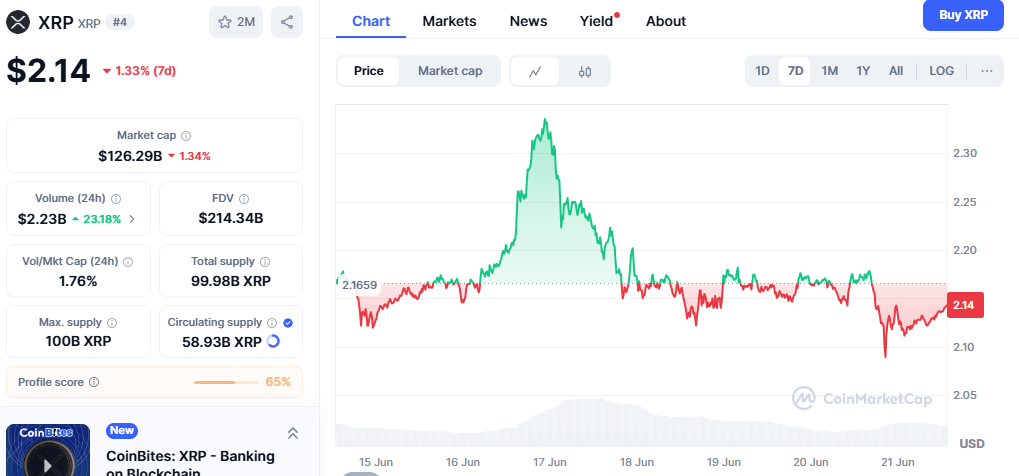

- XRP holds firm above $2 despite heavy retail profit-taking, with analysts like Chad Steingraber suggesting this may be the price floor before institutional investors step in.

- Glassnode data shows early holders realizing over $68 million per day in profits, while a segment of retail investors continues to HODL, anticipating further gains.

XRP is demonstrating impressive resilience amid a wave of profit-taking by retail investors, with analysts suggesting that institutional players may soon step in to drive the next phase of growth.

Professional gamer and cryptocurrency commentator Chad Steingraber believes XRP’s current price level represents a critical support zone. “Most XRP sellers have been retail, and yet still the price is holding over $2 the entire time,” Steingraber recently observed. According to him, this suggests XRP is establishing a solid floor ahead of institutional involvement.

Also read: Canada’s First XRP Spot ETF Falls After Launch — U.S. XRP ETF Approvals Could Be Next

Supporting this view, fresh insights from blockchain analytics firm Glassnode reveal significant profit realization in early June 2025. The firm’s data shows that XRP is trading more than three times higher than pre-November 2024 levels. Early holders who bought before last year’s rally are now sitting on profits exceeding 300%. In fact, realized profits peaked at an impressive $68.8 million per day, based on a seven-day simple moving average during the first week of June.

Despite this wave of selling, XRP has managed to stay firmly above the $2 mark. Glassnode’s charts display clear spikes in profit realization—particularly after XRP surged past $2—but without triggering a deep correction. This price stability suggests strong market demand and liquidity.

The market appears split: some retail investors are cashing out after booking substantial gains, while others remain committed to long-term targets. One user, Vincent, replied to Steingraber’s post saying, “Not me—I didn’t sell a single XRP unlike most retail. I actually have diamond hands—not selling till my targets hit.” His sentiment reflects a determined retail segment that continues to HODL, even as many peers exit.

As XRP’s price consolidates in this elevated range, analysts are watching closely for shifts in ownership patterns. Many believe institutional investors may soon enter, potentially providing fresh upward momentum.

For now, XRP’s ability to absorb heavy retail profit-taking while holding steady hints at a maturing market dynamic. The coming weeks could prove pivotal if institutional demand starts to materialize.