- Ripple’s global expansion and major institutional XRP purchases signal a potential breakout for the token, with resistance levels at $2.44 and $2.62.

- Cardano gains regulatory clarity and international traction, boosting long-term investor confidence as it eyes a breakout above the $0.71 resistance level.

As the cryptocurrency market braces for potential volatility, two major players—XRP and Cardano (ADA)—are making strategic moves that could reshape their price trajectories. From Ripple’s aggressive global expansion to Cardano’s regulatory milestones, the stage is set for possible price shocks in the near future.

Ripple Expands Across Europe and the Middle East

Ripple is gaining momentum in key global markets. In a significant European development, Germany’s DZ Bank, managing over €350 billion in assets, has adopted Ripple’s digital asset custody platform—marking its first full-scale rollout in the region. Meanwhile, Dubai’s financial regulator has officially recognized Ripple’s RLUSD stablecoin as a crypto token, strengthening Ripple’s footprint in the Middle East.

Institutional interest is also growing rapidly. Weebus International Limited revealed plans to acquire over $300 million worth of XRP to support its crypto infrastructure. Separately, financial services firm Hyperscale Data is preparing to buy up to $10 million in XRP by the end of 2025, signaling strong institutional confidence.

Also read: Dogecoin at Risk of Crashing to $0.14 as Meme Coin Market WeakensBy Albert Brown | June 5, 2025

XRP Eyes Breakout as Market Holds Steady

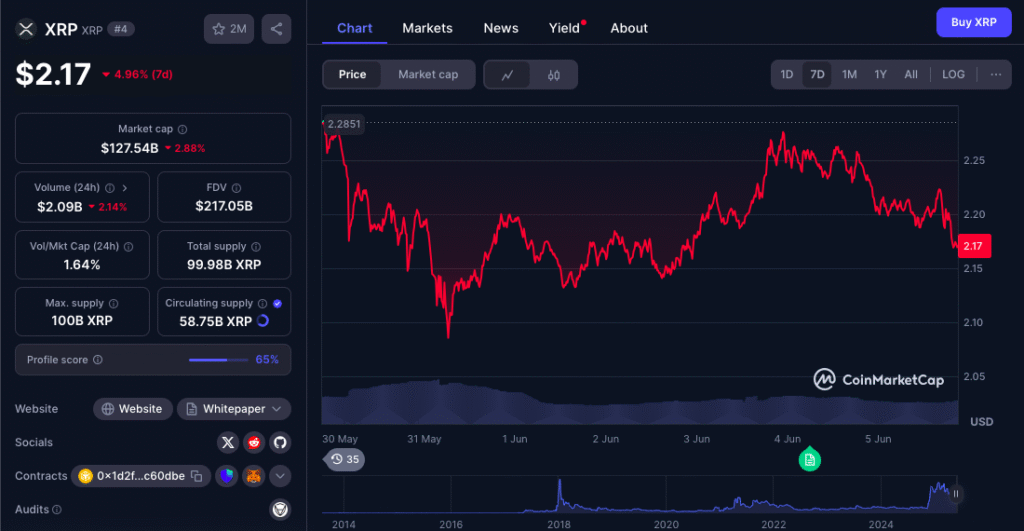

XRP’s price remains in a consolidation phase, but analysts suggest a major move is coming. If Bitcoin continues to decline, XRP could test support around $1.90–$2.00 before bouncing back. However, prolonged stability in this range could fuel a stronger breakout, with resistance levels looming at $2.44 and $2.62.

With institutional buying on the rise and global partnerships piling up, market sentiment is turning cautiously optimistic for XRP.

Cardano ETF Review and Japan Popularity Fuel Momentum

Cardano is gaining ground on multiple fronts. A potential Cardano ETF is under review by the U.S. SEC, with a decision expected by October 22, 2025. This, coupled with the SEC’s clarification that crypto staking is not a security, removes major regulatory roadblocks for ADA.

Cardano’s technological edge is also turning heads. A landmark transfer of Bitcoin to and from the Cardano network—without a bridge or third-party—has been achieved. Developer activity is surging, with Cardano surpassing Ethereum in GitHub commits this year. Nearly $1 billion in ADA has been withdrawn from exchanges in 2025, a sign of long-term investor confidence.

Price-wise, ADA is challenging resistance around $0.68–$0.71, with a possible dip to $0.61 before a larger move. With ETF potential and growing international adoption, Cardano’s bullish case is building momentum.