- The world’s first spot XRP ETF in Brazil, XRPH11, has plummeted over 20% since its launch, failing to meet investor expectations as XRP’s price struggles and the Brazilian market’s limitations hinder growth.

- All eyes are now on upcoming U.S. regulatory decisions regarding XRP ETFs, which could significantly impact the asset’s future and global investor sentiment.

The world’s inaugural spot XRP exchange-traded fund, XRPH11, has suffered a significant blow, plummeting over 20% since its highly anticipated launch in Brazil. Issued by Hashdex and listed on the B3 stock exchange, the ETF has failed to sustain investor momentum, mirroring a sharp decline in XRP’s underlying market value.

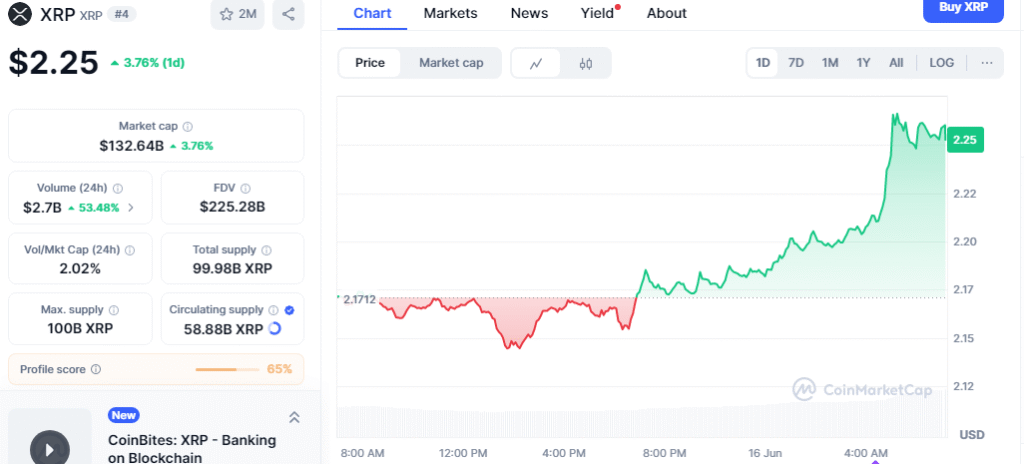

On June 13, XRPH11 closed trading at 18.65 BRL (approximately $3.37 USD), marking a 6.33% single-day drop. This latest dip brings the fund’s total losses to a staggering 20.6% in the last month, a stark contrast to the euphoria that surrounded its debut in late April.

Also read Solana Price Soars: $160 Breakout Imminent

Initial investor expectations that the ETF would ignite demand for XRP have largely unraveled. Instead, XRPH11 has closely tracked XRP’s erratic price movements, offering no discernible signs of sustained growth or substantial support from major investors. Despite occasional gains in XRP’s value, these upticks have proven insufficient to bolster the ETF’s worth, with the asset’s current price languishing around the $2 mark.

Market watchers attribute XRPH11’s limited impact, in part, to the inherent limitations of Brazil’s financial market. Compared to larger economies like the United States, Brazil offers lower liquidity and reduced institutional participation, factors that inherently restrict the growth potential of such an ETF. Compounding this challenge is XRP’s consistently weak performance, which has made it difficult for the fund to retain investor interest. The absence of consistent price appreciation has discouraged both retail and institutional holders from increasing their exposure to the asset.

As attention drifts from the Brazilian market, focus is increasingly shifting towards the United States. The U.S. Securities and Exchange Commission (SEC) is on the cusp of making a crucial regulatory decision regarding pending spot XRP ETF proposals from Franklin Templeton and WisdomTree. Both submissions are currently undergoing public review, and investors are keenly watching to see if a positive ruling in the U.S. could revive XRP’s fortunes in the broader market. The outcome of these applications is also expected to significantly influence investor sentiment towards related products worldwide, including XRPH11.

Adding another layer of complexity, Ripple and the SEC have sought a court decision to reduce the scope of restraints on institutional XRP sales. The ruling in this matter could further affect the regulator’s outlook for future ETF applications.

Meanwhile, XRP is currently trading at $2.16, registering a modest gain of 0.6% in the last 24 hours, but a concerning 4.3% decline over the weekly period. Market experts caution that unless there are significant regulatory advancements or fresh market triggers, both XRP and XRPH11 are likely to continue their struggle for sustained growth. The steep decline in XRPH11’s value serves as a stark reminder of the inherent challenges in launching crypto ETFs within emerging markets, where true momentum may ultimately hinge on regulatory clarity and broader global participation.