XRP Bulls Take Control as Price Jumps 17% in 24 Hours – Open Interest Hits $4.18B

More from the Author Cal Evans

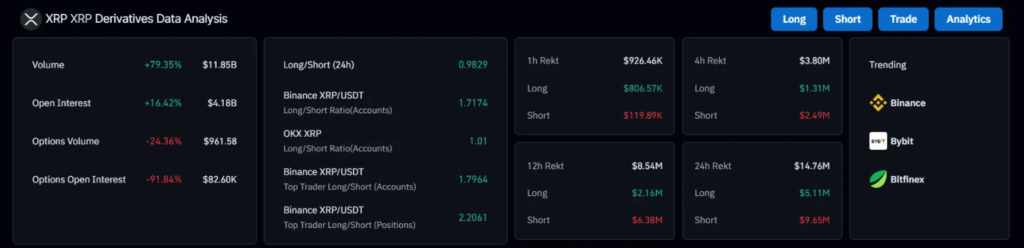

XRP surged 17% as SEC-approved ETF filings fueled investor enthusiasm, pushing Open Interest to $4.18 billion and derivatives volume up 80%.

Ripple CEO Brad Garlinghouse hinted at regulatory progress, while a $822 million XRP transfer sparked speculation on the crypto’s future trajectory.

Ripple’s native cryptocurrency, XRP, has taken the market by storm, surging 17% in just 24 hours. This significant rally comes as Bitcoin struggles to reclaim the $100,000 mark, making XRP one of the standout performers in a largely stagnant crypto landscape. The surge is attributed to renewed market enthusiasm, fueled by recent regulatory developments and increased investor speculation.

ETF Approval Sparks Frenzy

The US Securities and Exchange Commission (SEC) recently accepted filings from Grayscale to list spot XRP exchange-traded funds (ETFs). This pivotal move has sent waves of excitement across the crypto space, bringing XRP back into the spotlight. Additionally, the SEC’s acknowledgment of Grayscale’s Dogecoin ETF filing provided a slight boost to DOGE, which saw a modest 5% price increase.

The ETF news has pushed XRP’s Open Interest up by a staggering 16%, reaching $4.18 billion, according to Coinglass. Meanwhile, its derivatives trading volume has skyrocketed by nearly 80%, touching an impressive $11.85 billion. This dramatic spike in trading activity indicates that traders are bracing for even more significant price movements ahead.

XRP Defies Market Trends

While most major cryptocurrencies either recorded marginal gains or fell into the red, XRP decisively broke away from the broader market’s selling pressure. Over the past week, XRP has gained 12%, starkly contrasting Bitcoin’s 2% decline. At press time, XRP is trading at an average price of $2.69, with its 24-hour trading volume surging by 48% to stand at $8.09 billion.

Data from Coinglass reveals that more than $14.7 million worth of long and short XRP positions were liquidated in the past 24 hours. Interestingly, around $10 million (66%) of these liquidated bets were short positions, indicating that many traders expected further declines. However, the SEC’s ETF update has completely flipped market expectations.

Ripple CEO Signals Regulatory Shift

Adding fuel to the bullish sentiment, Ripple CEO Brad Garlinghouse has hinted at potential breakthroughs in US crypto regulations. He recently met with lawmakers in Washington, D.C., suggesting that bipartisan legislation is on the horizon. If realized, such regulatory clarity could provide a much-needed boost to the broader crypto industry.

Meanwhile, Ripple itself has been making substantial on-chain moves. The company recently transferred 300 million XRP—worth approximately $822 million—to an unknown wallet. This transaction was not part of Ripple’s routine monthly token releases, sparking speculation about its purpose.

What’s Next for XRP?

XRP’s recent rally to a two-week high of $2.75 has instilled fresh optimism among investors. With ETF speculation mounting and regulatory winds shifting, many traders anticipate further gains. If XRP maintains its momentum, it could set the stage for even greater price action in the coming weeks.

For now, all eyes remain on XRP as it continues to defy expectations and chart its own bullish course.

The post XRP Bulls Take Control as Price Jumps 17% in 24 Hours – Open Interest Hits $4.18B appeared first on Crypto News Focus.