- BNB started as Binance’s native token for trading fee discounts but has evolved into the backbone of the BNB Chain ecosystem, powering DeFi, dApps, and smart contracts.

- Its ongoing token burns, wide utility, and deep integration with Binance keep it highly relevant in 2025.

binance, short for Build and Build, started as Binance Coin—a utility token created by Changpeng Zhao (CZ) and Yi He in July 2017. Born during the height of the Initial Coin Offering (ICO) craze, binance launched with a clear goal: to give users a discount on trading fees within the Binance exchange. The strategy paid off. The ICO raised $15 million by offering 100 million tokens at just 11 cents each, instantly giving BNB real value in a rapidly growing crypto market.

Originally an ERC-20 token on Ethereum, BNB quickly evolved beyond its early function. In April 2019, Binance launched its own blockchain—Binance Chain—later forming part of the larger BNB Chain ecosystem. This allowed binance to become more than a discount token; it became the fuel for a thriving blockchain network.

Also read: Ethena’s High-Yield sUSDe Tokens Drain Liquidity from Aave: Is AAVE Price Heading for a Bearish Break?

BNB now powers the BNB Beacon Chain and BNB Smart Chain, playing multiple roles across the crypto space:

- Transaction Fees: Users pay network “gas” fees in , making transactions fast and cost-efficient.

- Smart Contracts & dApps: Developers use BNB to build decentralized applications (dApps) in sectors like DeFi, NFTs, and gaming.

- Staking & Validators: binance holders can stake their coins or delegate them to validators to earn rewards and support network security.

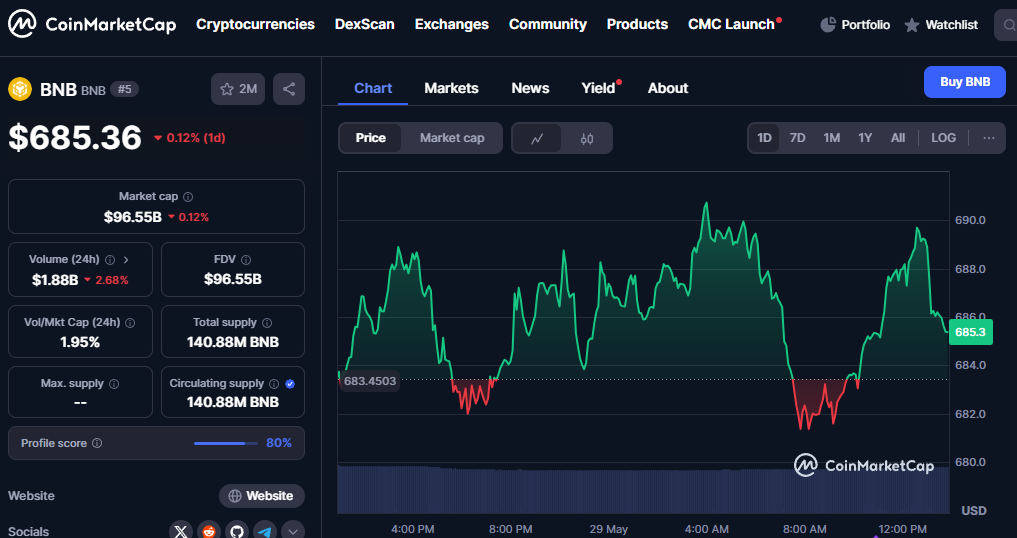

- Token Burns: Binance regularly burns BNB to reduce its total supply, creating scarcity and supporting long-term value.

- Real-World Utility: From trading discounts and Launchpad access to booking travel and paying merchants, BNB’s use cases extend beyond blockchain borders.

Why BNB Still Matters in 2025

longer just a way to save on fees—it’s the backbone of a vast Web3 ecosystem. Its continued integration into Binance’s platforms, combined with regular token burns and strong community adoption, has helped it remain one of the most-used coins in crypto.

Still, it’s not without risk. binance fate is deeply tied to Binance’s operations and regulatory challenges. But for investors and developers seeking a utility-driven, well-established crypto asset, remains a force to be reckoned with in 2025.