Key Takeaways

- A crypto exchange is a platform where users buy, sell, and trade cryptocurrencies securely and efficiently.

- Exchanges can be centralized (CEX) or decentralized (DEX), each with different control, security, and usability features.

- Understanding fees, liquidity, security, and regulatory compliance is crucial for safe crypto trading in 2025–2026.

What Is a Crypto Exchange?

As cryptocurrency adoption grows rapidly through 2025 and 2026, understanding crypto exchanges has become essential for anyone entering the digital asset market. Crypto exchanges are the gateways to buying, selling, and trading digital assets, offering the infrastructure that powers both retail and institutional participation in decentralized finance (DeFi) and Web3 ecosystems.

From trading Bitcoin and Ethereum to exploring altcoins and tokenized assets, crypto exchanges provide liquidity, price discovery, and secure transaction channels for millions of users worldwide

Centralized vs. Decentralized Exchanges

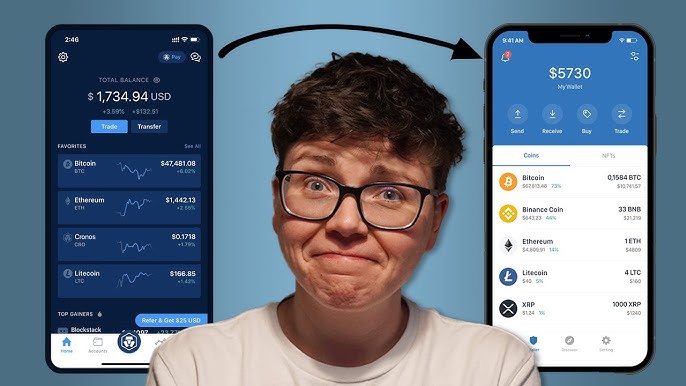

Crypto exchanges fall into two main categories: centralized exchanges (CEXs) and decentralized exchanges (DEXs).

Centralized Exchanges (CEXs)

Centralized exchanges are operated by companies that manage users’ funds, offer customer support, and maintain trading infrastructure. Popular examples include Binance, Coinbase, and Kraken.

Advantages:

- High liquidity and faster trade execution

- User-friendly interfaces

- Access to advanced trading tools, margin trading, and derivatives

Risks:

- Custody risk: users must trust the exchange to safeguard funds

- Regulatory compliance and potential withdrawal restrictions

- Vulnerable to hacks if the platform is compromised

In 2025–2026, CEXs remain popular for beginners and high-volume traders due to their convenience, but careful platform selection and security practices are essential.

Decentralized Exchanges (DEXs)

DEXs operate without a central authority, enabling peer-to-peer trades directly on blockchain networks. Examples include Uniswap, Sushiswap, and PancakeSwap.

Advantages:

- Full control over funds with self-custody wallets

- Lower censorship risk and global accessibility

- Transparency through smart contract-based execution

Risks:

- Lower liquidity compared to major CEXs

- Potential smart contract vulnerabilities

- More complex interfaces for beginners

DEXs are increasingly important in 2025–2026 as they power DeFi ecosystems and support interoperability across multiple blockchains.

Key Features of a Crypto Exchange

Liquidity and Market Access

Exchanges provide the infrastructure to match buyers and sellers, creating liquidity in crypto markets. High liquidity ensures smoother trades and smaller price slippage, which is crucial during volatile periods.

Trading Pairs and Asset Diversity

Most exchanges offer multiple trading pairs, allowing users to swap between cryptocurrencies and stablecoins. Some platforms also provide access to tokenized stocks, NFTs, and other digital assets, reflecting the growing integration of traditional and digital finance.

Security Measures

Security is a top concern in 2025–2026. Exchanges deploy measures such as:

- Two-factor authentication (2FA)

- Cold and hot wallets for asset storage

- Smart contract audits for DEXs

- Insurance funds to cover potential breaches

Understanding these measures helps investors choose platforms that minimize the risk of theft or loss.

Fees and Trading Costs

Exchanges charge fees for trades, deposits, withdrawals, and sometimes staking. Users must assess fee structures carefully, as costs can impact returns—especially for frequent traders.

Why Crypto Exchanges Matter in 2025–2026

Crypto exchanges are not just trading platforms—they are gateways to the broader blockchain economy.

- Onboarding New Investors – Exchanges make it easy for newcomers to access crypto markets without deep technical knowledge.

- Access to DeFi and Web3 – Many exchanges integrate staking, lending, and NFT markets, allowing users to participate in decentralized ecosystems.

- Price Discovery and Market Efficiency – By matching orders from a global pool of participants, exchanges provide accurate price signals that reflect market sentiment.

As adoption grows, exchanges are also becoming regulatory hubs, bridging the gap between traditional finance and the crypto world, enabling compliant trading and institutional participation.

Risks and Considerations

While exchanges offer access and convenience, users should be aware of key risks:

- Regulatory Changes: New rules may affect platform operations, token availability, or withdrawal processes.

- Security Threats: Hacks, phishing, and rug pulls remain possible, particularly on poorly secured platforms.

- Custody Risks: On CEXs, losing access to accounts or compromised platforms can result in permanent asset loss.

- Volatility: Rapid price movements can affect trade outcomes, requiring careful risk management.

In 2025–2026, smart users balance convenience with safety, choosing platforms based on reputation, liquidity, regulatory compliance, and security infrastructure.

Conclusion

A crypto exchange is the essential bridge between users and the global blockchain ecosystem. Whether centralized or decentralized, these platforms facilitate trading, liquidity, and access to emerging digital assets.

For investors in 2025–2026, understanding the types of exchanges, their benefits, and inherent risks is key to navigating the complex and rapidly evolving crypto landscape. Smart platform selection, coupled with strong security practices, positions users to benefit from the opportunities blockchain technology offers while minimizing exposure to risks.