- In a landmark move, Justin Sun’s Tron is set to go public in the U.S. through a reverse merger with Nasdaq-listed SRM Entertainment, establishing a $210 million TRX treasury in a strategy mirroring MicroStrategy’s Bitcoin holdings.

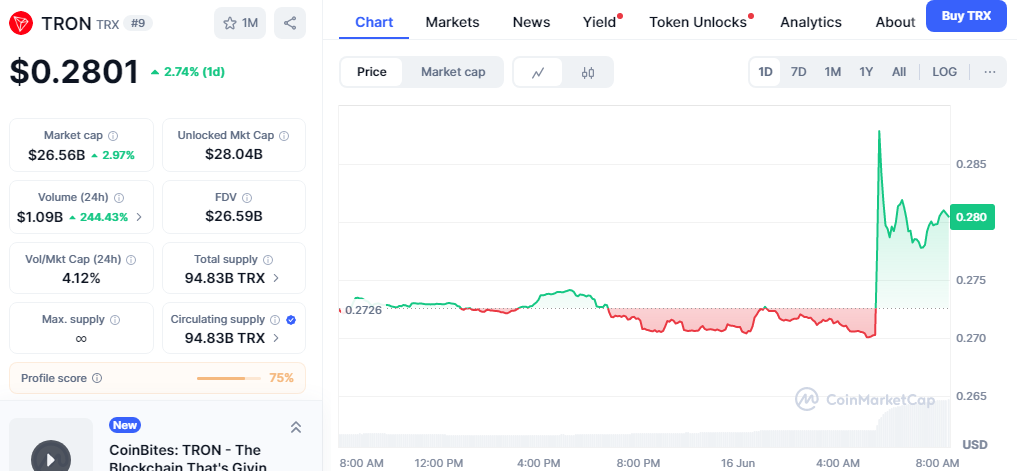

- This development, which saw TRX surge nearly 5%, signifies a major step toward mainstream financial integration for the blockchain project, especially following the recent dropping of SEC charges against Sun.

In a significant move that could reshape the cryptocurrency landscape, Tron, the blockchain project founded by the often-controversial Justin Sun, is reportedly poised to go public in the United States. This highly anticipated listing will not follow the traditional Initial Public Offering (IPO) route but rather a reverse merger with SRM Entertainment, a smaller entity already listed on the Nasdaq exchange.

The news, reported Monday by the Financial Times, sent a ripple of excitement through the crypto markets, with Tron’s native cryptocurrency, TRX, surging by nearly 5% on the announcement. Currently trading at $0.28, according to CoinGecko data, the price spike briefly allowed TRX to surpass meme coin Dogecoin (DOGE) in market capitalization, with both digital assets valued at approximately $26.5 billion.

Also read: Shiba Inu Whales Surge 248% While SHIB Price Dips: What’s Happening?

This strategic maneuver will see the newly formed company, to be rebranded as Tron Inc., establish an initial treasury of $210 million worth of TRX. This approach explicitly mirrors the successful “Strategy” playbook pioneered by MicroStrategy, the publicly traded business intelligence firm that has aggressively accumulated Bitcoin as a treasury reserve asset. The move signals a bold attempt to legitimize TRX as an institutional-grade asset and could attract a new wave of traditional investors seeking exposure to the Tron ecosystem without direct crypto holdings.

The decision to pursue a reverse merger allows Tron to bypass the often lengthy and rigorous IPO process, enabling a faster entry into the public markets. This development comes amidst a notable shift in the U.S. regulatory climate for cryptocurrencies. As previously reported by U.Today, the U.S. Securities and Exchange Commission (SEC) notably dropped its charges against Justin Sun in February 2025, signaling a potential thawing of aggressive crypto enforcement under the current administration. This regulatory reprieve has undoubtedly paved the way for Tron’s ambitious public listing.

The integration of a substantial TRX treasury within the publicly traded Tron Inc. could provide a new dimension of stability and demand for the token. Observers will be keenly watching how this “Strategy-like” bet influences TRX’s valuation and whether it inspires other major cryptocurrency projects to seek similar pathways to traditional financial markets. The coming months are set to be pivotal for Tron as it navigates its debut on the Nasdaq and endeavors to solidify its position in the global financial arena.