- Toncoin is consolidating within a symmetrical triangle, with bulls eyeing a breakout above the key $3.51 resistance.

- Despite growing buy-side pressure and investor accumulation, weak user activity and high unprofitable holder count may limit upside potential.

Toncoin Coils into a Tight Range: A Breakout Imminent?

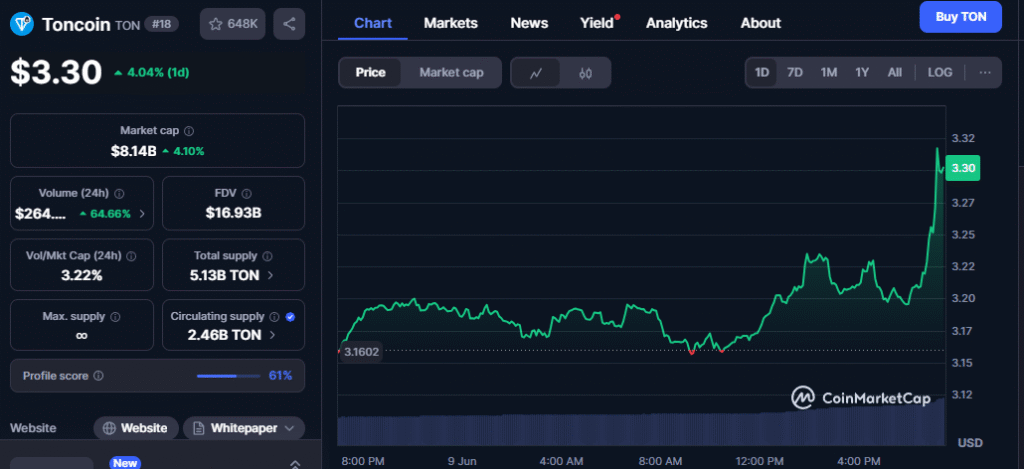

Toncoin (TON) is caught in a tightening symmetrical triangle, a chart pattern that often precedes major price swings. Trading at $3.16, TON faces a critical test at the $3.51 resistance zone. A breakout above this level could open the path toward the next target at $4.12. On the flip side, a failure to break out could cement the broader downtrend still visible on higher timeframes.

As price compresses near the triangle’s apex, the stage is set for a potential breakout or breakdown in the coming days.

Are Bulls Secretly Stacking TON?

Behind the scenes, the market shows subtle signs of bullish buildup. The 90-day Taker Buy CVD reveals strong buyer aggression—an early signal that bulls are lifting sell orders and preparing for an upward move. However, confirmation is still needed, especially a strong candle close above $3.51 supported by surging volume.

Until that happens, seasoned traders may remain on the sidelines, waiting for conviction.

Also read: XRP Price Prediction: Analyst Forecasts XRP Surge to $4.5 by August — Key Dates & Resistance Levels Explained

Profitless Holders Pose a Threat—or Opportunity?

On-chain data paints a tricky picture. Nearly 68.32% of TON holders are currently at a loss. While this could create selling pressure during a rally, it also presents an opportunity: if demand absorbs those exit attempts, it could lead to a supply squeeze and further price appreciation.

Essentially, whether these “out-of-the-money” holders sell or double down will shape the breakout’s strength.

Falling Network Activity: A Cause for Concern?

User fundamentals aren’t helping the bull case right now. Daily active addresses have dropped by 38.59%, and new addresses are down 53.13% over the past week. Without a turnaround in network engagement, bullish momentum might struggle to sustain.

Still, some traders may be in wait-and-see mode, ready to return if a breakout confirms renewed strength.

Speculators Watch, Investors Accumulate

While derivatives volume has jumped 24.84%, open interest dipped 1.08%, indicating short-term speculation without major conviction. Meanwhile, mid-sized investors increased their holdings by 4.01%, signaling quiet accumulation even as whales and retail reduced exposure.

This shift in ownership could be a bullish sign, as mid-tier investors often exhibit more stable behavior.

Verdict: Eyes on $3.51

With tightening price action, spot market buy dominance, and investor accumulation all aligning, Toncoin is poised for a decisive move. But weak fundamentals and bearish overhangs could still cap gains if the $3.51 breakout fails.

The next few sessions could be pivotal—will TON break out or burn out?