- Tether’s $1B mint on the Tron network narrows the gap with Ethereum in stablecoin dominance.

- As Tron’s lower fees and higher transaction volumes continue to rise, Ethereum risks losing its lead in the stablecoin market.

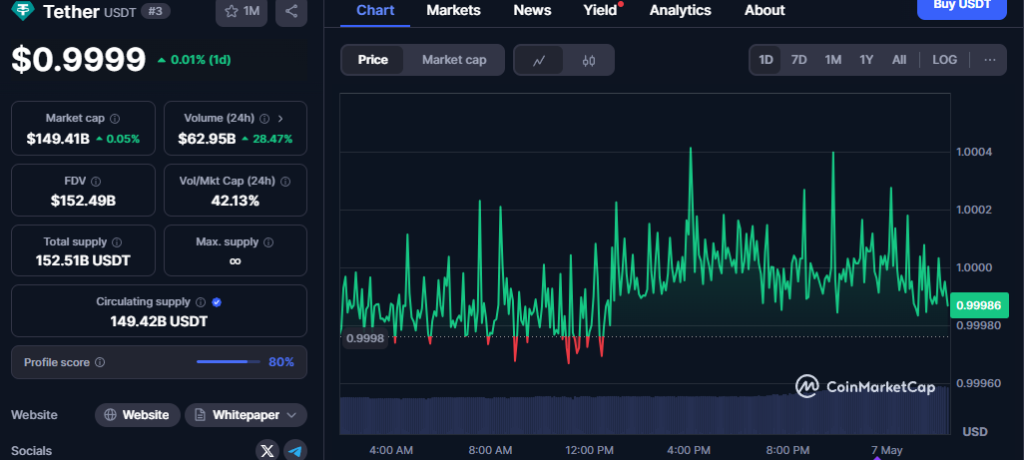

Tether’s latest $1 billion mint on the Tron network has ignited speculation over the future of stablecoin dominance. For years, Ethereum (ETH) has been the reigning champion in the stablecoin ecosystem, but with rising competition from faster, cheaper networks, could Ethereum finally lose its crown?

In a significant move, Tether minted another massive $1 billion in USDT on Tron (TRX), a network that has been steadily growing its stablecoin market share. The key difference? Tron offers low transaction fees and high speeds, two features that have made it an increasingly popular choice among stablecoin issuers and users alike.

Tron’s Rapid Rise

As of May 2025, Ethereum still leads with approximately $74.5 billion in USDT, but Tron is quickly closing the gap, and its meteoric rise over the past two years cannot be ignored. Data shows that Tron has been steadily increasing its share of the total USDT supply since early 2022, while Ethereum’s supply has plateaued and even dipped slightly in recent months.

The $1 billion mint on Tron is seen as a significant milestone, propelling the network closer to overtaking Ethereum in stablecoin supremacy. The chart reveals that Tron’s total USDT supply is now just a fraction below Ethereum’s, sparking fears that Ethereum’s long-standing dominance may soon be a thing of the past.

Also read: Coinbase x402 Protocol Revolutionizes AI with Autonomous Payments and Real-Time Stablecoin Transactions

Why is Tron Gaining Ground?

The key factor behind Tron’s growing stablecoin share is its ability to handle high-volume transactions at a fraction of the cost of Ethereum. Over the past year, daily transaction counts on Tron have skyrocketed, rising from around 6 million to consistently surpassing 9 million, with occasional spikes nearing 11 million. This surge in transactions signals a growing demand for Tron’s speed and efficiency in processing stablecoin transfers.

By contrast, Ethereum’s high gas fees have created a significant barrier to entry, particularly for stablecoin issuers like Tether. The costs associated with minting, transferring, and interacting with USDT on Ethereum remain far higher than on Tron. As a result, issuers and users are flocking to Tron’s more affordable ecosystem.

The Future of Stablecoins

Unless Ethereum makes significant improvements in scalability and transaction costs—beyond Layer 2 solutions—it risks losing its dominant position in the stablecoin market to faster, cheaper alternatives like Tron. The battle for stablecoin supremacy is intensifying, and with Tether‘s latest mint on Tron, the question remains: Is Ethereum about to be flipped?