- Tether has minted $3 billion in USDT on Ethereum and TRON, signaling increased market demand and liquidity needs.

- However, these networks remain hotspots for illicit stablecoin activity, raising regulatory concerns.

Tether, the issuer behind the world’s largest stablecoin by market cap, has ramped up USDT minting, issuing a staggering $3 billion in new tokens over just three days. The breakdown includes $2 billion minted on Ethereum and another $1 billion on TRON, signaling rising demand for liquidity across decentralized finance (DeFi) and centralized trading platforms.

This fresh wave of minting brings the total USDT supply on TRON to $71.71 billion, making it the leading blockchain for Tether issuance. In 2025 alone, Tether has minted over $12 billion USDT on TRON, reinforcing the network’s growing dominance in stablecoin circulation.

Also read: Uniswap Whales Move $102M in UNI to Coinbase, Triggering Sell-Off Fears Amid Bullish Breakout Signals

However, the increase in USDT issuance comes at a time of heightened scrutiny. According to a recent crypto crime report from Bitrace, Ethereum and TRON are home to most illicit stablecoin activities. In 2024, high-risk blockchain addresses on these networks received approximately $649 billion, a slight increase from the year before. The report defines these addresses as those used by illegal entities to receive, transfer, or store stablecoins like USDT and USDC.

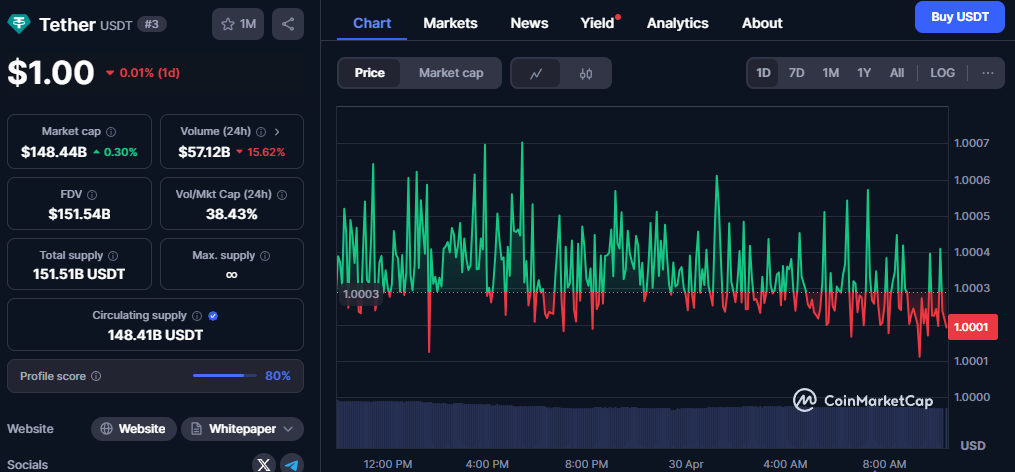

Despite this concerning backdrop, Tether maintains that all USDT tokens are backed 1:1 and issued to meet institutional and market demand.

Meanwhile, Ethereum’s price continues to consolidate near $1,800, facing resistance at the 50-day Exponential Moving Average (EMA) at $1,860. A breakout could trigger a bullish run toward $2,000, but lingering below key EMAs suggests caution. The Relative Strength Index (RSI) currently sits at 55.38, signaling neutral momentum with a slight bullish tilt.

TRON, on the other hand, is testing critical support at $0.24. With its RSI dipping below the midline at 50, downside risks are rising. A breach of this support could drag the price toward lower levels, potentially weakening the network’s bullish structure.

As Tether expands its footprint and markets stabilize, the focus turns to regulatory implications, particularly on how blockchain networks address the growing misuse of stablecoins.