- Tether has invested $5 billion in U.S. firms and holds $120 billion in U.S. Treasuries, making it a major player in American financial markets.

- The company aims to align itself with U.S. interests amid growing regulatory pressure on stablecoins.

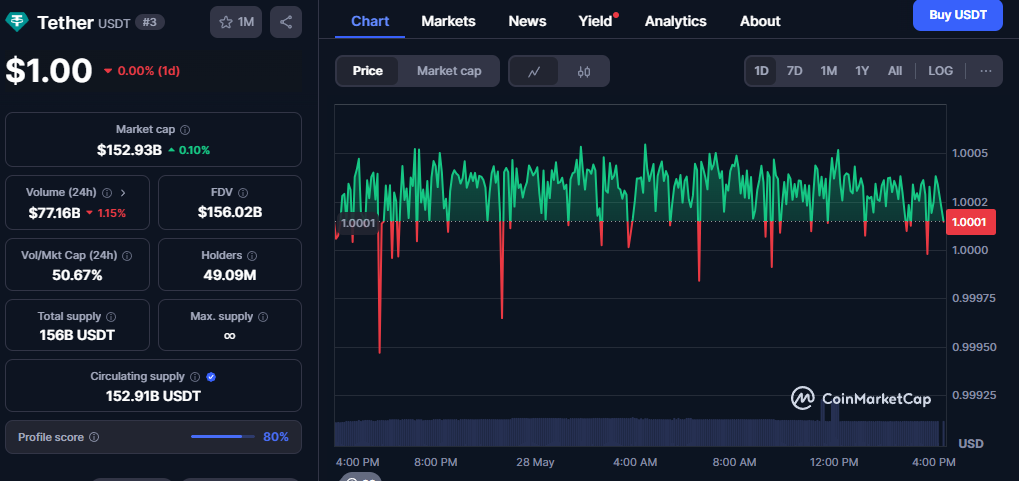

Tether, the world’s largest stablecoin issuer, has unveiled a bold new strategy: align itself with American economic interests as regulatory scrutiny intensifies. Over the past two years, the company has invested approximately $5 billion in U.S.-based companies, while simultaneously amassing $120 billion in U.S. Treasury holdings—a sum that makes it the 19th-largest holder of U.S. debt globally, outpacing countries like Germany and the UAE.

CEO Paolo Ardoino disclosed these figures via social media platform X, spotlighting a diversified investment portfolio. Among the highlights: $775 million in video-sharing platform Rumble, $200 million in neurotech firm Blackrock Neurotech (via Tether Evo), and a 21% stake in Bitcoin miner Bitdeer, which supports decentralized mining efforts through the OCEAN pool.

Also read: Solana Price Prediction: Cup and Handle Pattern Signals Potential Breakout Above $180

But these moves aren’t just about profit—they’re about positioning. With U.S. lawmakers tightening their grip on stablecoin regulations, Tether is broadcasting its commitment to bolstering the American economy. Ardoino argues that by backing most of its USDT reserves with Treasuries, Tether reinforces the U.S. dollar’s dominance, especially in underserved global markets.

Still, critics aren’t convinced. The company, now headquartered in El Salvador, has long faced scrutiny over its transparency practices and alleged links to illicit transactions. While Tether asserts it cooperates with law enforcement and continues to enhance its compliance frameworks, skeptics—including ETHNews analysts—highlight the firm’s opaque auditing and offshore operations.

Adding fuel to the fire, Ardoino recently accused rivals of lobbying against Tether, urging regulators to focus on substance over smear campaigns. Crypto investor Anthony Pompliano called Tether “one of the most important pro-America companies,” citing its 400 million users and strong profitability.

As the stablecoin wars heat up, Tether’s latest strategy is clear: anchor its brand in economic patriotism and U.S. dollar advocacy. Whether this gambit fosters lasting legitimacy or invites deeper regulatory scrutiny may well define the company’s next chapter.