- Tether has acquired a 32% stake in Canadian gold royalty firm Elemental, marking a strategic move to back its USDT stablecoin with tangible assets like Gold and Bitcoin.

- The investment reflects Tether’s broader goal to build a more resilient, decentralized financial infrastructure.

Tether Expands Into Gold Mining

In a groundbreaking move that signals its ambition to diversify and strengthen its stablecoin ecosystem, Tether has announced the acquisition of a 32% stake in Elemental Altus Royalties Corp., a Canadian-listed, gold-focused royalty company. The strategic investment is part of Tether’s broader mission to embed resilient, real-world assets such as Gold and Bitcoin into its financial infrastructure.

Tether Investments, an affiliate of the USDT issuer, acquired 78,421,780 common shares from La Mancha Investments, marking a significant step into the traditional commodities sector. This acquisition represents about 31.9% of Elemental’s total shares and was executed through a private offshore agreement.

Also read: Litecoin Price Prediction: LTC Rejected at $95 Resistance as Bearish Momentum Strengthens

Doubling Down on Gold and Bitcoin

Beyond the initial stake, Tether has secured an option to further its investment through an agreement with AlphaStream Limited and Alpha 1 SPV Limited—subsidiaries under Tether’s umbrella. The optional deal involves purchasing an additional 34,444,580 Elemental shares, potentially raising Tether’s ownership significantly by October 29, 2025, pending regulatory and shareholder approval.

Tether CEO Paolo Ardoino underscored the importance of Gold and Bitcoin in building a more transparent and inflation-resistant financial system. “This is not just about investment—it’s about building financial infrastructure for the next century,” he stated.

A Strategic Shift Toward Real Asset-Backed Stability

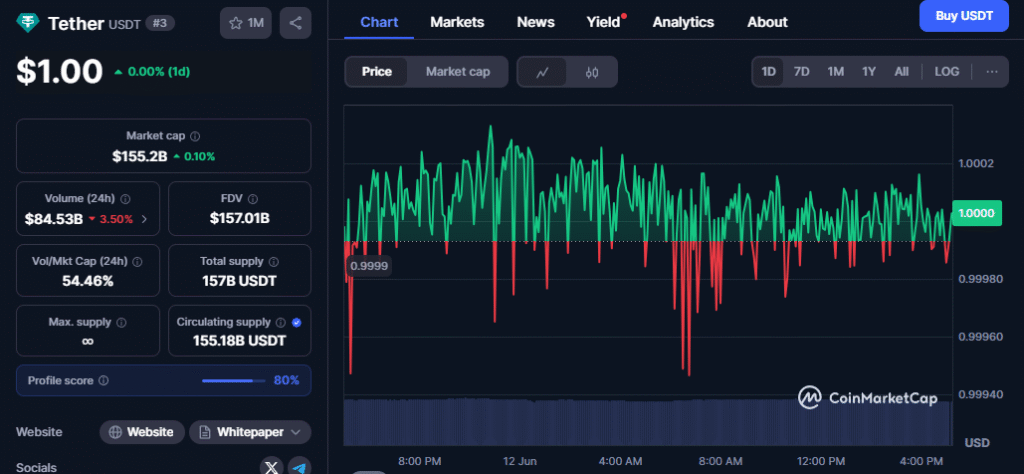

With a market cap of approximately $155 billion, Tether’s USDT remains the world’s largest stablecoin. However, this latest move highlights a deeper strategy. By integrating nearly 80 tons of physical gold and 10,000 BTC into its reserves, Tether is aligning itself with a dual-pillar approach—using both Gold and Bitcoin as complementary hedges against traditional economic instability.

This calculated expansion into gold royalties signals that Tether is serious about long-term stability and financial resilience—cementing its position not only in the digital asset world but increasingly in the physical one too.