- Sui is outperforming Solana in key areas like DeFi activity, stablecoin transfers, and user growth, driven by strong on-chain metrics and rising investor interest.

- The buzz around a potential Sui ETF and global partnerships is further boosting its appeal to both retail and institutional investors.

User Activity and DeFi Boom Signal Strong Network Growth

The Sui blockchain is rapidly emerging as a dominant force in the digital asset landscape, overtaking Solana in several critical performance metrics. Recent data reveals that daily active addresses on the Sui network surged by over 14% from Q4 2024 to Q1 2025, indicating rising user engagement and expanding adoption of decentralized finance (DeFi) applications. Notably, decentralized exchanges (DEXs) on Sui saw trading volumes increase by 14.5%, reaching $34.3 million.

Sui’s lending protocols are also outperforming, offering up to 12.69% annual returns on stablecoins—almost double the yield found on Solana-based platforms. Moreover, Sui now facilitates more daily stablecoin transfers than Solana, a clear sign that trust in its financial infrastructure is strengthening.

Also read: Crypto Market Plunges Amid Trump-Musk Feud and Massive Liquidations

ETF Filing and Global Partnerships Draw Institutional Eyes

Investor interest in Sui is intensifying amid speculation over a potential exchange-traded fund (ETF). Asset manager 21Shares has filed for a Sui ETF listing on both the NASDAQ and Cboe exchanges. If approved, the ETF could mark a significant step in bringing institutional capital into the ecosystem, further solidifying Sui’s role in mainstream finance.

Adding to the momentum, Sui has partnered with Dubai’s Virtual Assets Regulatory Authority to support the region’s virtual asset startups. This strategic alliance is expected to enhance Sui’s global reach and regulatory credibility, particularly in a rapidly evolving crypto policy landscape.

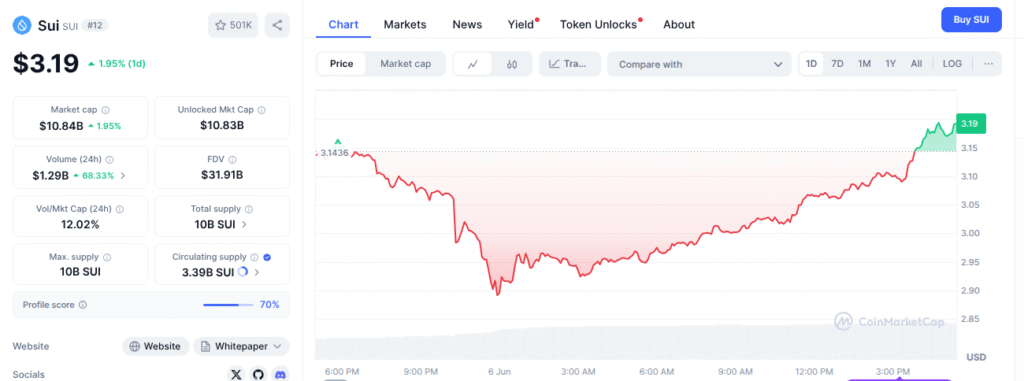

Price Volatility Persists, But Market Sentiment Remains Bullish

At present, SUI is trading at $3, reflecting a 5% dip from its recent highs. Analysts predict a short-term correction to $2.75 before bullish momentum resumes. Key resistance levels to watch include $3.38, $3.74, and $4.22. Despite the current market pullback, sentiment remains optimistic as investors weigh the long-term impact of the ETF news and growing on-chain activity.

With surging user engagement, attractive DeFi yields, and the potential for ETF exposure, Sui is positioning itself as a serious contender in the blockchain arena—challenging Solana’s dominance and attracting attention from investors worldwide.