- The crypto market anticipates significant price volatility for Sui (SUI) and Solana (SOL) as over $250 million worth of tokens are set to unlock in early July, potentially increasing selling pressure.

- While SUI faces fragile bullishness and a risk of price drops if support levels fail, SOL shows signs of consolidating within a bullish pennant, with some analysts optimistically eyeing a push towards $185.

The cryptocurrency market is bracing for a critical period as two prominent Layer-1 tokens, Sui (SUI) and Solana (SOL), are set to undergo significant token unlocks in early July. With a combined value exceeding $250 million poised to enter circulation, investors are keenly watching for potential price volatility.

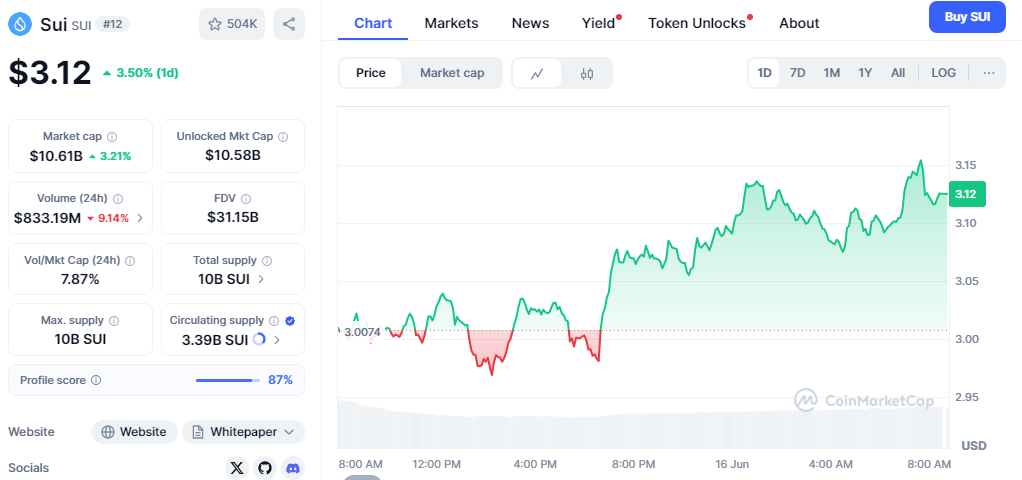

On July 1, Sui Network will release 58.35 million SUI tokens, an amount valued at approximately $178.53 million. This represents a notable 0.58% of Sui’s total supply and a substantial 1.71% of its current market capitalization. The influx of these tokens, previously locked, could exert considerable selling pressure on SUI.

Also read: Tron Goes Public: $210M TRX Bet Mirrors MicroStrategy in Landmark US Listing

Adding to the market’s attention, Solana is also slated for two distinct unlock events. On July 1, the FTX Estate will unlock 12.7K SOL tokens, worth around $1.99 million. This will be followed by a more substantial release on July 7, when an additional 472.99K SOL, valued at approximately $74.06 million, will become available. These unlocks, particularly from the FTX Estate, often carry an increased risk of immediate liquidation, potentially leading to downward price movements for SOL.

Analyzing Sui’s current technical posture, the token is trading around the $3.06 mark, precariously testing the 0.382 Fibonacci retracement level at $3.0224. While this level could offer temporary support, a failure to hold it could see SUI slide towards the 0.5 Fibonacci level at $2.8556, and potentially even the golden ratio (0.618) at $2.6887. Despite a recent spike in the Balance of Power (BoP) indicator to 0.30, suggesting short-term buyer dominance, this metric remains highly susceptible to rapid reversals once the unlock-driven supply hits the market. The inability of SUI to decisively break above the $3.22 resistance (Fib 0.236) further underscores the fragile bullish sentiment.

Conversely, some analysts maintain a cautious optimism for Solana despite its upcoming unlocks. Renowned technical analyst World of Charts highlights that SOL is currently consolidating within a bullish pennant pattern. A successful breakout from this formation could propel Solana towards the $185 resistance level, with a decisive daily close above it potentially opening the door to the psychological and technical barrier of $250.

The impending token unlocks introduce an element of uncertainty into the market for both SUI and SOL. While Solana benefits from a more established ecosystem and recent positive sentiment surrounding potential ETF approvals, Sui’s nascent market capitalization makes it more susceptible to price fluctuations from large token releases. Investors are advised to closely monitor demand-supply dynamics and broader market sentiment as these key dates approach.