- Solana founder Anatoly Yakovenko slammed the idea of altcoin projects holding Bitcoin, calling it “so dumb” and urging teams to focus on low-risk assets for operational needs.

- His criticism came in response to Cardano’s Charles Hoskinson proposing a $100 million BTC treasury strategy to stabilize ADA’s ecosystem.

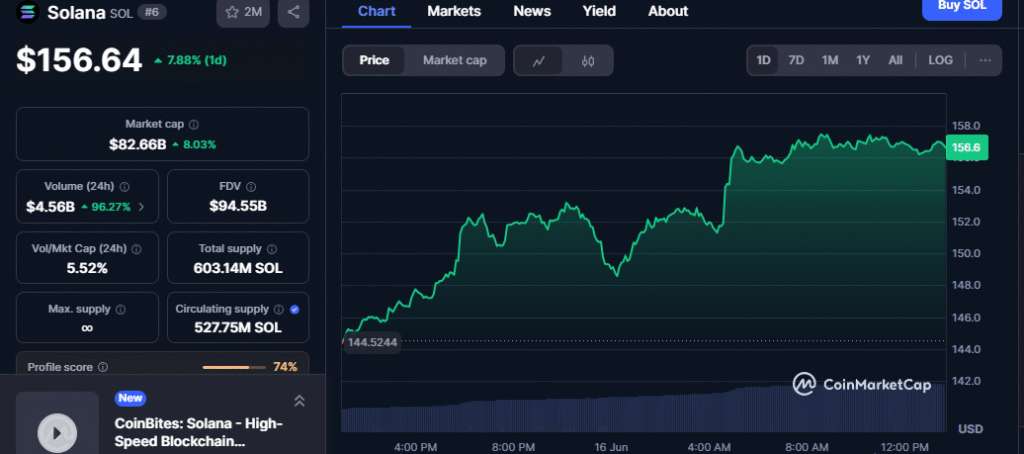

Anatoly Yakovenko reignites debate over altcoin projects holding BTC, calling the trend unnecessary and misguided.

- Solana founder Anatoly Yakovenko slammed the idea of altcoin projects holding Bitcoin, calling it “so dumb” and urging teams to focus on low-risk assets for operational needs. His criticism came in response to Cardano’s Charles Hoskinson proposing a $100 million BTC treasury strategy to stabilize ADA’s ecosystem.

Solana co-founder Anatoly Yakovenko is stirring up crypto Twitter again — this time by calling out the growing trend of altcoin projects converting their own tokens into Bitcoin. In a blunt post, Yakovenko labeled the idea of a project buying Bitcoin on behalf of its community as “so dumb,” questioning why anyone would delegate that responsibility when they could simply buy and hold BTC on their own.

“Why would anyone want a team to buy and hold bitcoin for them when they can do it themselves? Why pay for all those coconuts,” Yakovenko remarked, criticizing the unnecessary risk and inefficiency of such treasury strategies.

Also read: Bitcoin’s Bull Run Not Over? 30 Indicators Signal $230K Target, Recommend “Hold 100%” Approach

Instead, he recommends a more conservative approach, suggesting that altcoin projects should only hold enough to cover 36 months of operating expenses — ideally in low-risk assets like U.S. tresd: reasury bills.

This heated reaction follows a recent proposal from Cardano co-founder Charles Hoskinson, who floated the idea of converting $100 million in ADA into Bitcoin and other stable assets. Hoskinson argued that the move would not impact Cardano negatively and could, in fact, strengthen its long-term stability. By using yields generated annually, the project could repurchase ADA and replenish its treasury.

“If that program is successful, then we can actually continue that strategy on an annualized basis,” Hoskinson explained, envisioning a stable economic floor for the Cardano ecosystem.

However, not everyone is buying it. Bitwise’s Jeff Park called the move baffling, saying, “Subpar altcoins ditching their own assets to build a BTC treasury was not on my 2025 bingo card.”

The debate goes deeper than just treasury strategy — it touches on altcoin identity, long-term value, and the evolving definition of “sound money.” Hoskinson previously declared that Bitcoin no longer holds the exclusive right to that title, saying, “We will not allow the maxi and the Bitcoin ecosystem to take it from us.”

As altcoins grapple with sustainability, one thing is clear: the battle between self-sovereignty and strategic centralization is far from over.