Key Takeaways:

- U.S. shutdown fueled volatility, but crypto innovation accelerated.

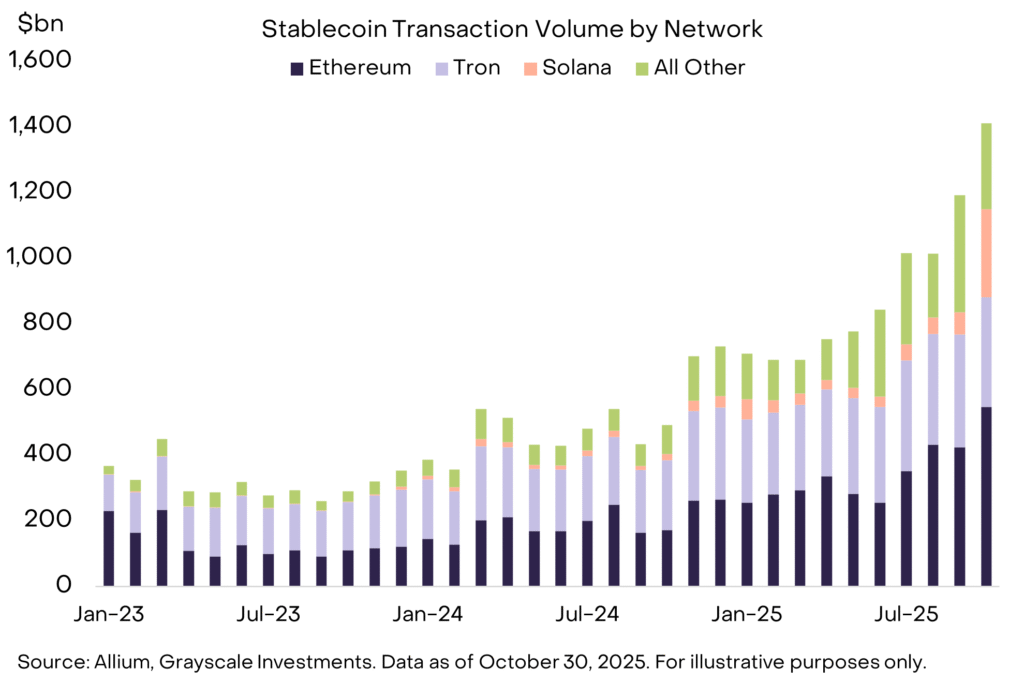

- Stablecoin transactions hit $1.4T; ETPs introduced staking rewards.

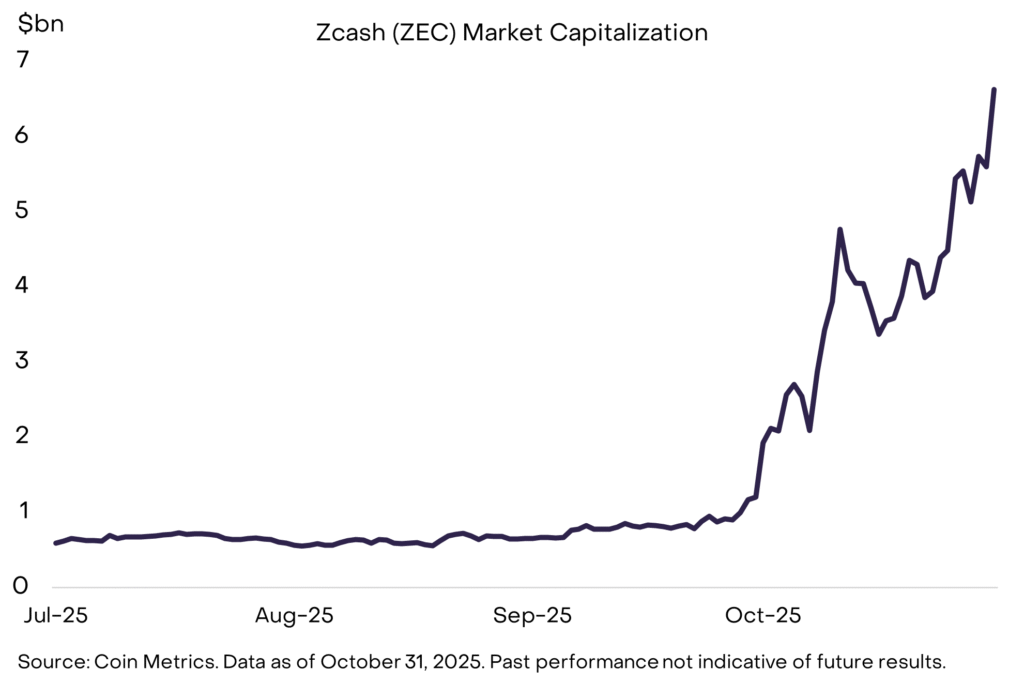

- Zcash soared 248%, spotlighting rising demand for blockchain privacy.

- Regulatory clarity and institutional adoption remain key 2026 catalysts.

Innovation Outpaces Uncertainty

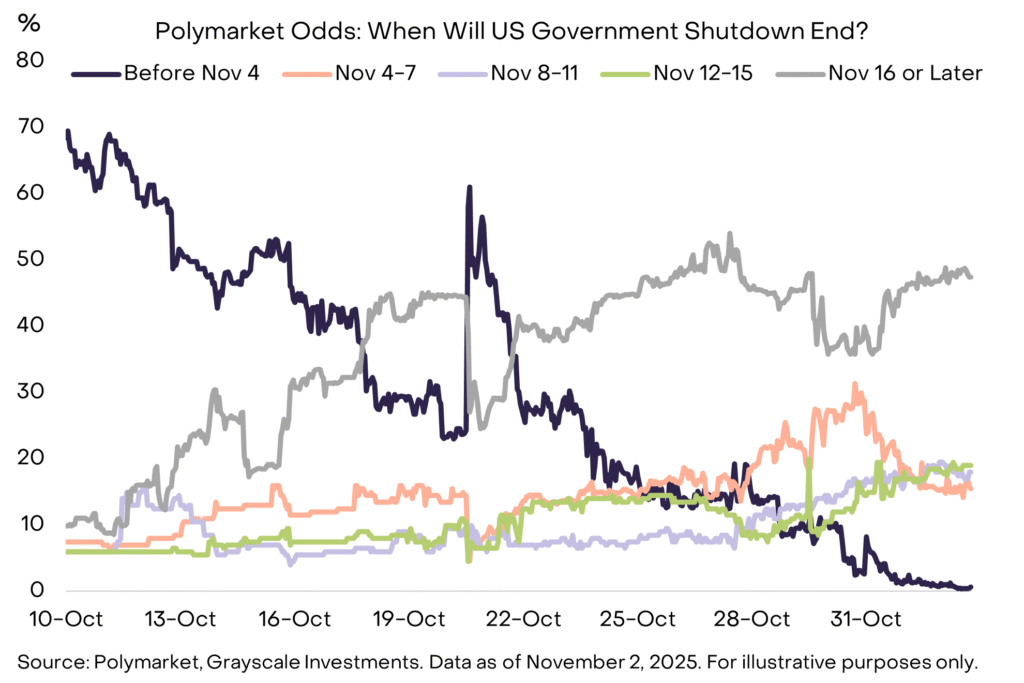

October 2025 tested investor nerves as the U.S. government shutdown, ongoing since October 1, extended market uncertainty. Combined with higher tariff risks and fading hopes for a December rate cut, global markets saw increased volatility. Yet, despite the macro gloom, the digital assets industry proved resilient — marked by significant progress in regulation, product innovation, and privacy-focused crypto assets.

Stablecoins and Altcoin ETPs Take Center Stage

While equities struggled to find direction, stablecoin adoption hit new highs. According to Allium data, monthly transaction volumes reached $1.4 trillion, with total supply exceeding $300 billion for the first time — much of it driven by Solana’s network efficiency. Major payment firms including Mastercard, Visa, and Western Union announced strategic stablecoin initiatives, signaling institutional confidence in blockchain-based payments.

Crypto investment products also evolved rapidly. U.S. issuers launched exchange-traded products (ETPs) that combined staking rewards with exposure to new “altcoins” under the SEC’s updated Generic Listing Standards. Investors can now earn staking yields — around 3% for Ethereum and up to 7% for Solana — directly through these regulated investment vehicles, marking a major leap toward mainstream accessibility.

Also Read: What Is a Stablecoin?

Zcash’s 248% Surge Highlights Privacy Demand

Amid a broadly weaker crypto market, Zcash (ZEC) emerged as a standout performer, surging 248% in October to a $6.5 billion market cap. Its appeal lies in optional privacy features via shielded transactions — now used by nearly 30% of holders, up from 10% in 2024.

Also Read: How Zcash Is Redefining What Encrypted Money Can Do

Grayscale Research emphasizes that blockchain technology’s potential depends on preserving user privacy, forecasting growing institutional focus on privacy-oriented protocols as public blockchains integrate deeper into global finance.

Policy Progress and Crypto Resilience

Heading into year-end, macro conditions — from the unresolved U.S. shutdown to global trade negotiations — will likely dictate near-term sentiment. Yet, with bipartisan talks on crypto legislation advancing in the Senate and continued innovation in tokenized finance, the foundations for recovery appear strong.