- Despite a massive 248% increase in whale transactions, Shiba Inu’s price continues to decline, leading to concerns that large holders are selling off their assets.

- This unusual divergence suggests a potential distribution phase, with technical indicators hinting at further price weakness for the popular meme coin.

The world of cryptocurrency is abuzz with perplexing movements in the Shiba Inu (SHIB) market. While a staggering 248% surge in whale transaction activity might typically signal bullish sentiment, an in-depth look at on-chain data paints a starkly different picture: SHIB’s price continues its gradual decline, raising questions about the true nature of these large-volume transfers.

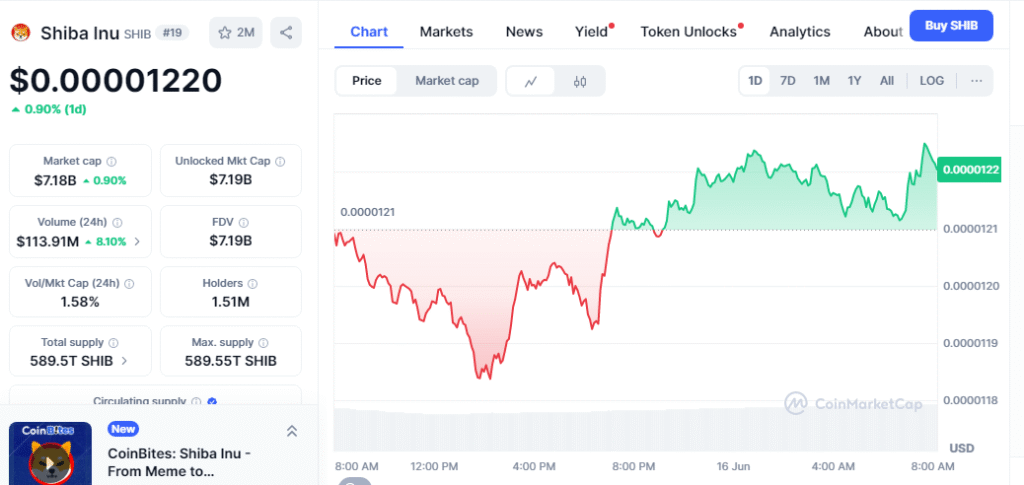

According to a recent report, major holders, often referred to as “whales,” are orchestrating a significant increase in transfers ranging from $1 million to $10 million. In a healthy market, such a spike would generally precede or accompany a price rally, indicating accumulation and strong buying interest. However, SHIB’s current trajectory contradicts this conventional wisdom. The popular meme coin is reportedly struggling to maintain its footing, hovering precariously around the $0.00001217 support level.

Also read: Ethereum Price Stalls: Why $153M Inflow Can’t Move ETH

Further compounding the mystery, technical indicators offer little hope for an immediate recovery. SHIB remains stubbornly below all major moving averages, with the 200 Exponential Moving Average (EMA) acting as a formidable, uncontested resistance. The Relative Strength Index (RSI), a key momentum indicator, also exhibits persistent weakness, barely clinging to neutral territory. This divergence between high whale activity and a falling price is a glaring contradiction that warrants closer scrutiny.

Market analysts are now speculating that these large transactions might not be a sign of bullish accumulation, but rather a strategic maneuver by big players to offload their holdings. With retail trading volume showing a decline and technical signals flashing red, these whale movements could be a tell-tale sign of “exit liquidity,” where large holders are selling into existing demand, even if it’s dwindling.

Should the critical support level at $0.00001200 fail to hold, SHIB could face a significant downturn, potentially sliding into sub-$0.0001000 territory – a price point not seen since early 2024. Such a scenario would undoubtedly deliver a severe blow to investor confidence, particularly for those who entered the market during its peak hype.

In conclusion, while the recent surge in Shiba Inu whale activity certainly highlights continued interest in the token, it is far from a universally bullish indicator. Instead, the current market dynamics suggest that these large-scale movements may be the initial tremors of a deeper distribution phase, hinting at a brittle market with limited liquidity. Investors are urged to conduct thorough research and exercise extreme caution when navigating these uncertain waters.