- Shiba Inu faces increased bearish pressure as whale investors offload holdings and only 23% of the supply remains in profit.

- With weakening technical indicators and falling Open Interest, SHIB risks a deeper correction toward year-to-date lows.

Whale Exodus Sparks Alarm for SHIB Investors

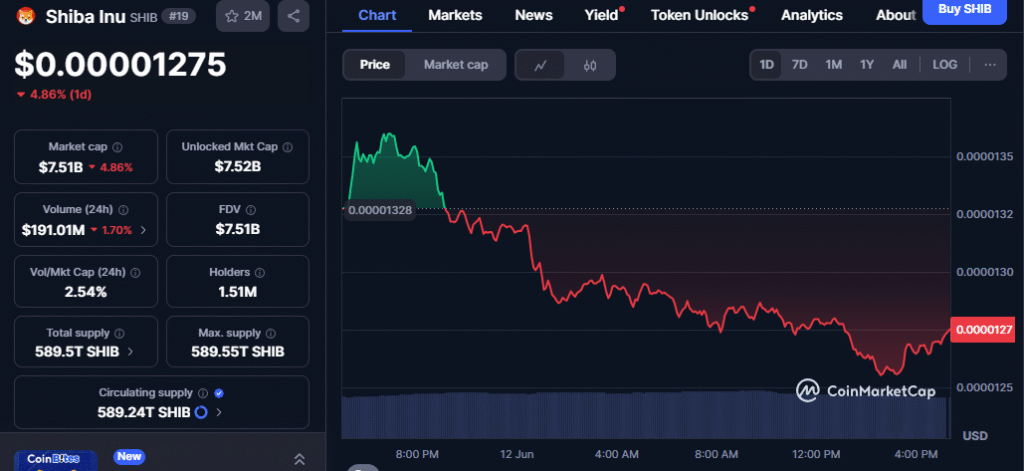

Shiba Inu (SHIB) continues its downward trajectory, dropping another 2.40% on Thursday after a 3.22% decline the previous day. Facing resistance at the 50-day Exponential Moving Average (EMA), SHIB’s technical structure shows signs of weakness as major investors—commonly referred to as whales—trim their holdings. According to Santiment, whales holding between 10 million and 1 billion SHIB tokens have collectively reduced their stash by over 700 billion tokens since the beginning of 2025. This decline in whale confidence signals potential trouble ahead for long-term holders.

Fewer SHIB Holders in Profit as Sentiment Weakens

The drop in SHIB’s price has had a dramatic impact on investor profitability. Currently, only 23% of the supply is in profit, a steep fall from 75% at the start of the year. This metric highlights increased pressure on holders and suggests a bearish overhang in the market. The exodus of whales may further deteriorate sentiment and discourage fresh accumulation.

Also read: Tether Acquires 32% Stake in Canadian Gold Mining Company Elemental to Strengthen USDT Backing

Derivatives Data Paints a Bearish Picture

Adding to the bearish momentum, CoinGlass data reveals a 3% drop in Open Interest (OI) to $172 million, hinting at waning interest in SHIB futures. A sharp imbalance between long and short liquidations—$331K vs. $15K—suggests that bullish positions are being wiped out. With the long/short ratio at 0.8871, bearish bets are on the rise, while the funding rate of 0.0084% shows that remaining bulls are still clinging on, albeit with caution.

Key Support Levels Could Be Tested Soon

From a technical standpoint, SHIB’s MACD indicator remains flat, showing a lack of bullish momentum, while the RSI has dropped to 43—further confirming weakness. If the bearish trend continues, SHIB could test support at $0.00001200, with further downside potential toward $0.00001150 and the year-to-date low at $0.00001029.

A Possible Rebound? Not So Fast

While a broader crypto market recovery could help SHIB reclaim levels above $0.00001421, the odds appear slim without stronger fundamentals or whale reinvestment. Unless the meme coin can break above the resistance levels at $0.00001550 and $0.00001700, bearish pressure is likely to dominate in the near term.