- Bitcoin dropped 2.33% from $106,150 to around $103,400, but large wallets are quietly accumulating as retail holders exit.

- Michael Saylor fueled debate with a Matrix-themed Bitcoin tweet, reinforcing long-term bullish sentiment despite short-term market volatility.

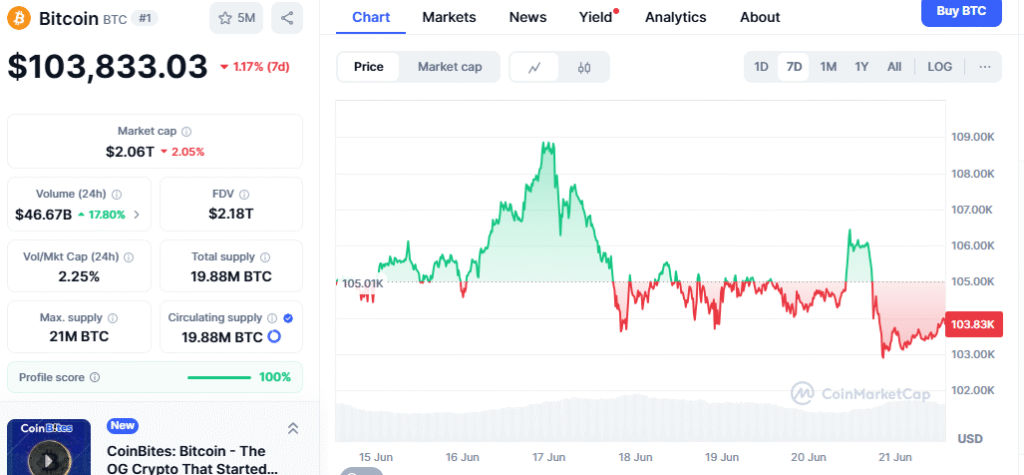

Bitcoin (BTC) is once again proving its resilience — and dividing opinions — after a sharp price correction this week. The world’s largest cryptocurrency fell by 2.33% over the last 24 hours, sliding from $106,150 to around $103,400. It’s now down nearly 5% since Monday’s local peak of $108,850.

As prices dipped, Bitcoin advocate and Strategy executive chairman Michael Saylor stirred discussion with a viral post referencing The Matrix — the iconic sci-fi film loved by Bitcoin libertarians. “Tickets to escape the Matrix are priced in Bitcoin,” Saylor wrote, posting an AI-generated image of himself. While the analogy resonates with many in the community seeking financial freedom from centralized systems, Saylor’s stance remains more pragmatic. He has previously argued that both self-custody and institutional custody (including banks) are valid approaches for BTC holders.

Also read: XRP Price Steadies Above $2 as Retail Profit-Taking Slows and Institutional Interest Grows

Behind the memes, Bitcoin’s on-chain data is flashing interesting signals. According to Santiment, large wallets — those holding 10 BTC or more — have quietly accumulated over the past 10 days. The number of these wallets has grown by 231, marking a 0.15% increase. On the flip side, smaller wallets (holding between 0.001 and 10 BTC) have seen a sharp decline, with 37,465 wallets emptied — a 0.15% drop.

This divergence suggests that whales remain confident in Bitcoin’s long-term value, even as retail sentiment turns more cautious during this correction. Santiment analysts noted that this mix — big wallets buying while small holders sell — has historically set the stage for bullish momentum.

In short: while BTC’s price action may look shaky in the short term, institutional conviction remains strong — and with thought leaders like Saylor continuing to frame Bitcoin as a path to greater financial freedom, many are betting the long-term uptrend isn’t over yet.