- OM is facing intense downward pressure, with 91% of holders at a loss, retail interest fading, and whale dominance increasing amid weak demand.

- Unless a major catalyst emerges, the token’s recovery appears unlikely as short sellers tighten their grip.

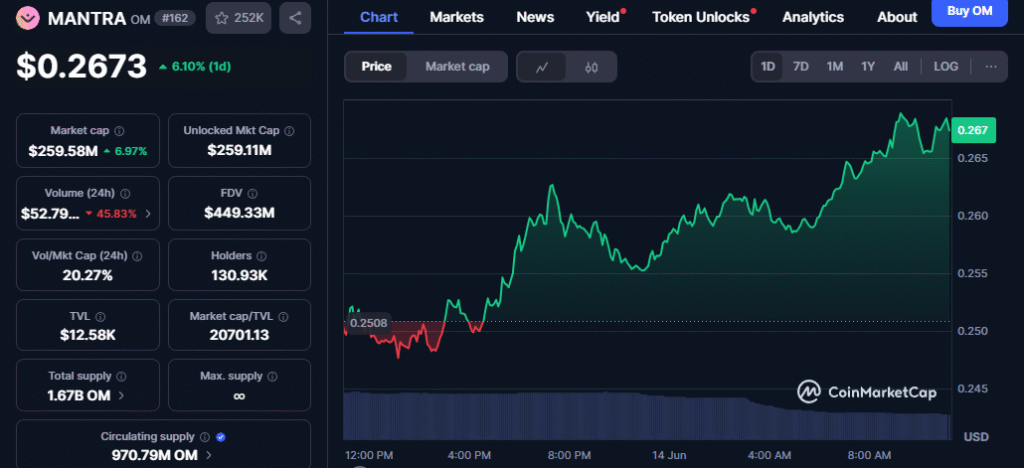

Mantra (OM) is teetering on the edge as its once-promising rally has turned into a dramatic collapse. With over 91% of holders now underwater and daily trading sentiment sinking fast, OM’s future looks increasingly uncertain. The token recently dropped over 12% in a single day, sliding to $0.2516—a brutal extension of a downtrend that began in early April, erasing months of gains.

Retail Pullback Meets Whale Dominance

A troubling shift in investor dynamics is accelerating the decline. While whale wallets increased their OM holdings by 2% over the past month—suggesting long-term conviction—retail and mid-tier holders have sharply reduced their exposure. Retail holdings dropped 7.56%, while mid-tier wallets fell by 4.33%. This growing centralization may offer temporary price stability but signals weakening community confidence.

Also read: $3 Billion in Bitcoin Options Expire Today – Will BTC Price Crash or Recover?

Demand Deteriorates, Institutions Back Off

On-chain data further underscores the collapse in confidence. Large Transaction Volume—often a proxy for institutional activity—plummeted by 24.34%, reflecting a steep drop in big-money involvement during the sell-off. Meanwhile, new wallet addresses surged by 18.6%, but the excitement fizzled as active wallets barely moved, rising only 0.44%. Even more concerning, zero-balance addresses fell 17%, indicating many long-time holders may have fully exited.

The Weight of Unrealized Losses

A staggering 91.91% of OM holders remain “Out of the Money,” with dense resistance zones forming between $0.28 and $0.76. Any rebound could be met with immediate selling pressure from trapped investors looking to escape, creating a persistent ceiling on price recovery.

Shorts Tighten Their Grip

The liquidation map paints a grim picture: short positions are mounting around $0.25, and leverage is rising. With long positions already flushed below $0.24, market sentiment remains bearish, and without a sudden shift in fundamentals, OM’s fate could be sealed.

Can OM Rebuild?

In its current state, OM is a token in crisis. Whale dominance, lackluster retail interest, and mass unrealized losses paint a bleak outlook. Unless a powerful catalyst reignites demand, OM risks becoming yet another fallen star in the volatile world of crypto.

OM isn’t dead—but survival now hinges on a major turnaround in sentiment and utility. Without that, the house of cards may continue to fall.