- Litecoin is showing signs of a classic dead-cat bounce, with technical and on-chain indicators pointing to a potential double-digit price drop from resistance levels around $93 to $95.

- Rising profit-taking and dormant wallet activity suggest increased selling pressure, making a retest of $83.31 or lower likely unless LTC breaks above $96.30.

Litecoin (LTC) may be in for a rude awakening as its recent recovery rally is showing all the signs of a dead-cat bounce—a temporary rebound before another steep drop. After slipping below key technical supports, LTC is now approaching a make-or-break zone between $93.70 and $95.80. However, this zone could become a trap for hopeful bulls and an opportunity for bearish traders.

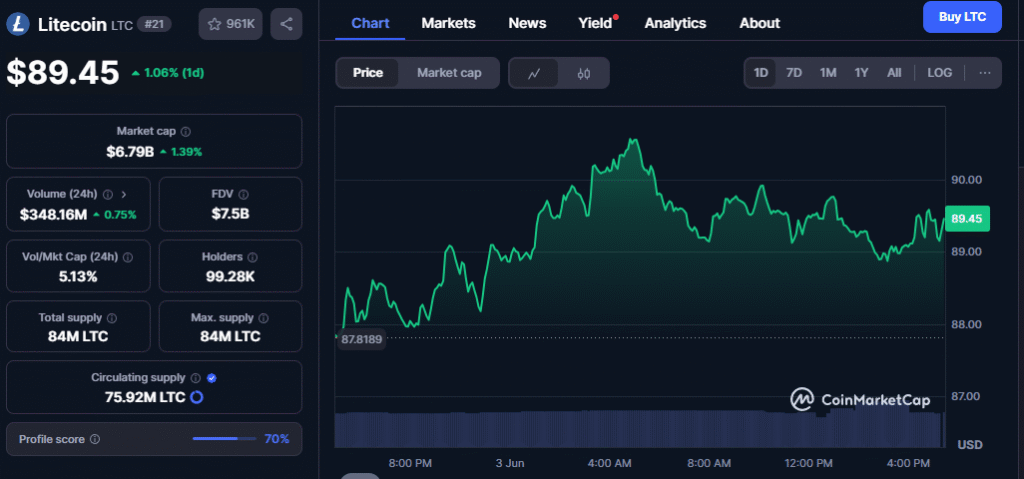

Currently hovering around $89.30, Litecoin’s price action appears to be stalling after recovering slightly from an 8.12% decline last week. This pullback followed a break below both the 200-day Exponential Moving Average (EMA) and an ascending trendline that had been in place since early April—two significant technical support levels now turned resistance.

Also read: Tether Launches XAUt0: Gold-Backed Stablecoin on TON Blockchain Now Available via Telegram Wallet

Bearish On-Chain Data Backs the Sell-Off

On-chain metrics further reinforce the bearish case. According to Santiment, Litecoin’s Network Realized Profit/Loss (NPL) showed its highest spike in profit-taking since March, indicating many holders are cashing out. Adding to the concern is the spike in Santiment’s Age Consumed metric, which suggests long-dormant wallets are moving coins—usually a sign that selling pressure is about to increase.

These patterns typically precede local tops, hinting that the current bounce might be short-lived. Traders aiming to short LTC might consider doing so between $93.70 and $95.80, with a stop-loss set just above $96.30. If the rejection happens as expected, LTC could retest its recent low of $83.31 and possibly fall further to the next support level at $77.19.

Indicators Flash Red

The Relative Strength Index (RSI) currently sits at 44, below the neutral 50 mark—signaling that bearish momentum is still in play. Meanwhile, the MACD indicator has triggered a bearish crossover, reinforcing the likelihood of continued downward movement.

Bullish Breakout? Not So Fast

If Litecoin surprises and closes above $96.30, the bearish thesis would be invalidated. This would open the door for a move toward the May 10 high of $107.05. Until then, the risks remain tilted to the downside.

Litecoin’s bounce may just be a bull trap. Traders should tread carefully—this could be the calm before another storm.