3 Key Takeaways

- Transferring crypto to a wallet gives you full control and protection from exchange risks.

- Always verify your wallet address and network — errors can result in permanent loss.

- Self-custody is the future of crypto in 2025–2026, empowering users to own their financial freedom.

How to Transfer Crypto from Exchange to Wallet Safely in 2025

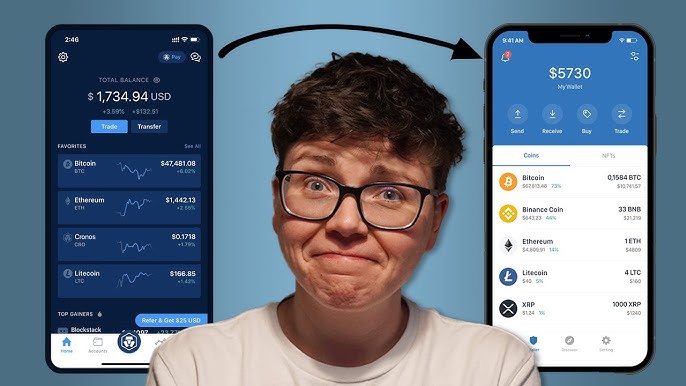

As cryptocurrency adoption continues to accelerate into 2025 and 2026, more users are realizing the importance of self-custody — controlling their own crypto rather than leaving it in centralized exchanges.

Whether you’ve just bought your first Bitcoin or you’re diversifying your portfolio across Web3 platforms, understanding how to transfer crypto from an exchange to a wallet is a fundamental skill. Done right, it’s simple and secure. Done wrong, it can mean irreversible loss.

This guide explains the process clearly, highlights what’s changed in the 2025 landscape, and offers insights on protecting your assets in a world where “not your keys, not your coins” remains the golden rule.

Why Moving Crypto Off Exchanges Matters

Centralized exchanges (CEXs) — like Binance, Coinbase, and Kraken — remain vital gateways for buying and selling crypto. Yet, recent events have reminded users that keeping funds on exchanges comes with risks.

Outages, hacks, and regulatory freezes throughout 2024 and early 2025 have pushed more investors to embrace non-custodial wallets, where they alone control their private keys.

The 2025 market has also seen growing popularity in decentralized finance (DeFi), where interacting directly with protocols requires having your crypto in a wallet — not an exchange account.

Simply put: transferring crypto from an exchange to a wallet gives you control, flexibility, and security. You own the keys, and therefore, the coins.

Step 1: Choose the Right Wallet

Before you initiate a transfer, you need a secure and compatible wallet.

There are two main categories to consider:

- Hot wallets (software-based): Free, internet-connected, and user-friendly. Examples include MetaMask, Trust Wallet, and Phantom.

- Cold wallets (hardware-based): Offline physical devices like Ledger or Trezor that offer maximum security for long-term storage.

In 2025, many wallets are multi-chain — meaning they support several blockchains, from Bitcoin to Ethereum and Solana. This feature is especially useful as new networks like Base and Aptos gain traction.

When choosing, prioritize:

- Security reputation

- Ease of use

- Supported assets

- Backup and recovery features

If you’re a beginner, start with a free, non-custodial hot wallet before upgrading to hardware solutions as your holdings grow.

Step 2: Verify Your Wallet Address

Once your wallet is set up, it’s time to locate the public address for the crypto you’re transferring.

Each blockchain uses a unique address format — for instance:

- Bitcoin addresses start with “1”, “3”, or “bc1”.

- Ethereum and compatible tokens start with “0x”.

- Solana uses alphanumeric strings unique to its network.

Always double-check you’re copying the correct address for the specific crypto and network. Sending Bitcoin to an Ethereum address, for example, will permanently lose your funds.

In 2025, many wallets and exchanges have adopted address validation tools or QR code scanning to prevent these errors. Some even include AI-driven verification prompts that flag mismatched networks before you confirm a transfer.

Step 3: Initiate the Transfer from Your Exchange

Now you’re ready to send your crypto from the exchange to your wallet.

Here’s a step-by-step breakdown:

- Log in to your exchange account.

Navigate to the “Withdraw” or “Send” section. - Select the cryptocurrency you want to transfer.

- Paste your wallet’s address or scan its QR code.

- Choose the correct network.

(For example, if you’re sending USDT, confirm whether it’s on Ethereum, Tron, or another blockchain.) - Enter the transfer amount and review fees.

- Confirm the transaction using two-factor authentication (2FA).

Exchanges typically show an estimated transfer time — anywhere from a few seconds to several minutes, depending on blockchain congestion and network type.

As of 2025, some platforms have introduced instant withdrawals using layer-2 networks like Arbitrum, Base, or Lightning Network, dramatically reducing fees and wait times.

Step 4: Verify the Transaction

Once you’ve initiated the transfer, monitor its progress through the blockchain’s public ledger (called an explorer).

For example:

- Bitcoin transactions → blockchain.com/explorer

- Ethereum → etherscan.io

- Solana → solscan.io

Enter your wallet address or transaction ID to confirm its status.

In 2025, many modern wallets automatically notify you once a transaction is confirmed — often within seconds — thanks to real-time blockchain monitoring integrations.

Once the funds appear in your wallet, congratulations — you’ve successfully transferred your crypto off the exchange.

Safety Tips for 2025 and Beyond

While transferring crypto is straightforward, a few simple precautions can make all the difference between security and disaster:

- Start small. Test with a small transfer before sending large amounts.

- Enable 2FA and withdrawal whitelists on exchanges.

- Avoid copying addresses manually — use QR codes or wallet integrations to prevent typos.

- Beware of phishing scams. Always confirm you’re on the official exchange or wallet app.

- Back up your seed phrase offline. Never store it on your phone or cloud.

Emerging tools in 2025, such as AI-driven anti-phishing alerts and biometric wallet access, make managing crypto safer — but vigilance remains your best defense.

How Transfers Work in 2025: The Tech Behind the Process

Under the hood, transferring crypto is about broadcasting a transaction request to a blockchain network. Miners or validators confirm it, add it to the distributed ledger, and update balances accordingly.

The move toward proof-of-stake (PoS) networks — like Ethereum’s post-Merge ecosystem — has made these processes faster and more energy-efficient.

In 2025, innovations like zero-knowledge rollups (ZK-rollups) and cross-chain bridges have made transfers cheaper and more seamless. Some wallets even automate network selection to minimize fees and confirmation times — making crypto transfers almost as effortless as sending a text.

Common Mistakes to Avoid

Even with better technology, beginners still make costly mistakes when moving crypto from exchanges to wallets. The most common include:

- Sending to the wrong address or network. (Always verify compatibility.)

- Falling for fake wallet apps. Download only from verified sources.

- Ignoring gas fees. Ethereum or Solana congestion can spike transaction costs temporarily.

- Losing seed phrases. Without your backup, lost access is permanent.

In 2025, exchanges like Binance and Kraken now provide preview warnings for incompatible addresses — but it’s still the user’s responsibility to confirm every detail.

The Future of Self-Custody (2026 and Beyond)

As regulatory pressure on centralized exchanges increases globally, self-custody is emerging as the cornerstone of the crypto economy.

By 2026, expect to see:

- Integrated recovery systems for lost wallets using encrypted multi-signature backups.

- Smart contract-based wallets that add spending limits and emergency recovery features.

- Seamless fiat on-ramps that let users buy crypto directly into self-custody wallets.

These innovations will make it even easier — and safer — to manage digital assets without middlemen.

Still, the principle remains unchanged: control your keys, control your crypto.

Also read : Top 10 Free Crypto Wallets for Beginners

Conclusion: Taking Control of Your Crypto Future

Learning how to transfer crypto from exchange to wallet is more than a technical skill — it’s a rite of passage for anyone serious about digital ownership.

In 2025, with more users entering crypto through mainstream apps and global ETFs, self-custody is no longer niche; it’s a necessity.

Moving your funds into a wallet gives you true control — security from exchange failures, flexibility to explore DeFi, and peace of mind that your assets are truly yours.

As we look toward 2026, one principle stands stronger than ever: in the decentralized economy, ownership begins with self-custody.