From $10 Billion to $4.1 Billion: What’s Behind Pepe Coin’s $6 Billion Market Cap Drop and What’s Next?

More from the Author Cal Evans

Pepe Coin has experienced a significant 46% drop in value since December, losing $6 billion in market cap, with reduced investor interest reflected in declining futures open interest.

Despite this, a growing number of holders remain loyal, and there are signs that the token could potentially rebound if a falling wedge pattern leads to a breakout.

Pepe Coin, once a highly popular meme token, has experienced a significant decline in its market value, losing a staggering $6 billion in market cap since December. The token, which had reached a high of $10 billion, now finds itself at a much lower market cap of $4.1 billion. This dramatic drop is part of a larger trend that has seen several meme coins take a hit recently.

Market Volatility and Declining Investor Interest

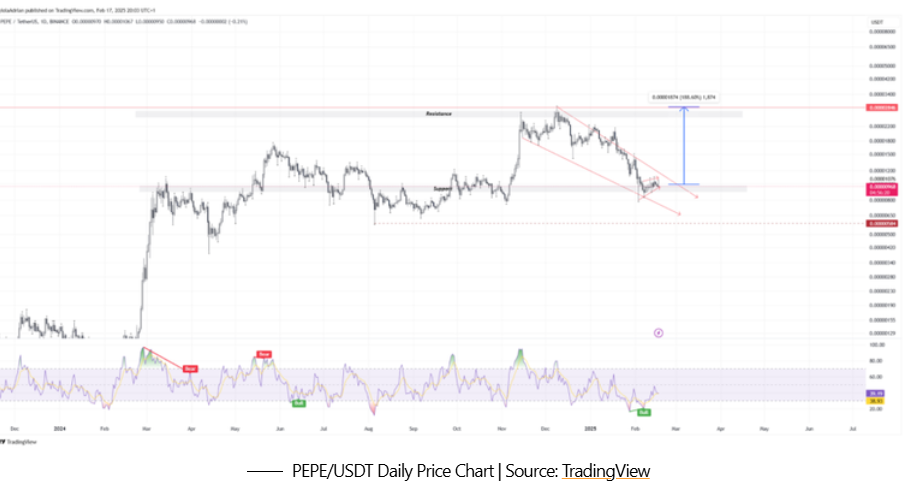

The sharp decline in Pepe Coin’s value can be attributed to a series of market factors. Since December, Pepe’s price has dropped 46%, leaving investors concerned about its future. A look at the price chart reveals a clear downtrend, with lower highs and lower lows. Currently, the token is holding at a support level of $0.000010, but the price continues to form a bearish pattern.

A key indicator of the current market sentiment is the decline in futures open interest. In January, futures open interest stood at over $556 million, but by now, it has dropped significantly to $258 million. This reduction suggests that investor interest in Pepe Coin is waning, as many traders are moving away from the token.

Pepe’s Holders: A Loyal Community Amidst the Decline

Despite the ongoing downturn, the number of Pepe Coin holders has increased. Data from CoinCarp shows that the number of holders rose from 384,000 to 404,100 over the past month. This suggests that a dedicated group of investors is holding on to their tokens, possibly in the hope of a recovery.

However, technical indicators continue to point towards bearish market conditions. The chart shows a “death cross” pattern, where the 50-day and 200-day Weighted Moving Averages have crossed. This pattern is traditionally seen as a bearish sign, indicating that the market could continue its decline.

A Potential Reversal or Further Decline?

Despite the gloomy outlook, there is a glimmer of hope for Pepe Coin. The chart also displays a falling wedge pattern, which can often signal a potential breakout. If this pattern holds true, Pepe could experience a reversal, with the price rising to $0.000028, offering a potential gain of 188% from its current level.

However, caution remains essential. The Relative Strength Index (RSI) is currently at 39%, well below the neutral 50% level, signaling that the bears are still in control. Additionally, the price is forming a bearish flag pattern, which could suggest further declines. Some analysts predict that the token could dip as low as $0.0000058, a level not seen since August of the previous year.

In conclusion, while there are signs of a possible rebound, Pepe Coin’s future remains uncertain. Investors should proceed with caution, keeping an eye on key technical indicators and market trends before making any decisions.

The post From $10 Billion to $4.1 Billion: What’s Behind Pepe Coin’s $6 Billion Market Cap Drop and What’s Next? appeared first on Crypto News Focus.