- FARTCOIN faces rising bearish pressure after a $2.3 million whale selloff, weakening market sentiment and fueling concerns of a deeper correction.

- With fading momentum, growing exchange outflows, and long liquidations surging, bulls must act swiftly to prevent further downside

FARTCOIN is under intensifying bearish pressure after a $2.3 million whale selloff sent shockwaves through the market, sparking concerns over a deeper correction.

On-chain data confirms that a large holder offloaded 2.18 million FARTCOIN, just two months after accumulating the position—locking in an estimated $251K profit. The profit-taking, occurring amid fragile market sentiment, appears to have triggered widespread unease among smaller investors and ignited a bearish cascade.

Also read: Bitcoin Market Cools, But Why the $100K Support Remains Crucial2 min read

Fading Post-Listing Euphoria

The Binance.US listing had initially sparked a 66% surge in daily trading volume, pushing activity to $373 million. However, the post-listing enthusiasm quickly evaporated. Weighted sentiment has dropped sharply to -0.59, signaling growing pessimism among traders.

Although the listing generated short-term speculative buying, it failed to build lasting confidence. Combined with the whale dump, this has left the market vulnerable to further downside, as momentum stalls.

Bearish Momentum Builds

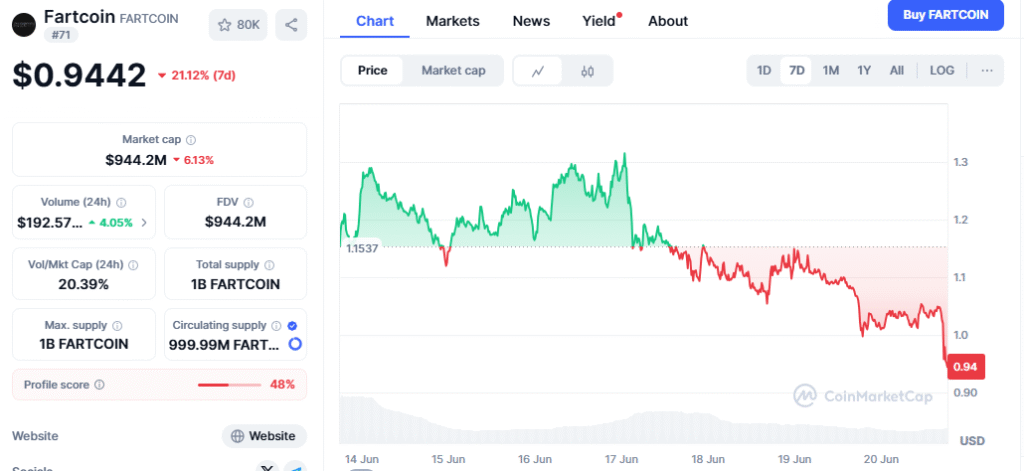

At the time of writing, FARTCOIN was trading near $1.02—testing key former support levels. Despite maintaining a cup and handle formation on the charts, the handle is losing strength as price compresses into a tight range.

Oversold signals on the Stochastic RSI suggest potential for a bounce, but bulls have yet to show conviction. Without renewed demand, bears may soon take full control.

Rising Exchange Outflows Add Pressure

On-chain metrics show -$739K in net outflows to exchanges on June 20, suggesting more FARTCOIN is being positioned for potential liquidation rather than accumulation. This sustained outflow, combined with whale selling, makes it difficult for bullish momentum to rebuild.

Liquidations Reveal Bullish Fatigue

Liquidation data confirms the pressure is mounting on the bulls. Long liquidations totaled $103K on June 20—dwarfing $22K in shorts. Bybit alone saw $71K in liquidated longs, as overleveraged bullish bets continued to be unwound.

As directional conviction weakens and volatility remains high, both bulls and bears now face rising risks. However, the imbalance in liquidations suggests bullish fatigue is the dominant force.

Correction Risk Growing

FARTCOIN’s technical structure remains intact for now, but the combination of whale exits, negative sentiment, rising exchange outflows, and long liquidation pressure raises the odds of a deeper correction. Bulls must act swiftly to defend key levels—or risk seeing sellers take command of the market.