- Fartcoin is currently trapped in a range-bound pattern due to weak buying pressure, struggling to break the key $1.5 resistance despite some bullish signals like strong support at $1 and higher On-Balance Volume levels.

- Traders are advised to watch for a decisive volume breakout before expecting a sustained rally, as the memecoin’s future hinges on overcoming this persistent resistance with stronger market demand.

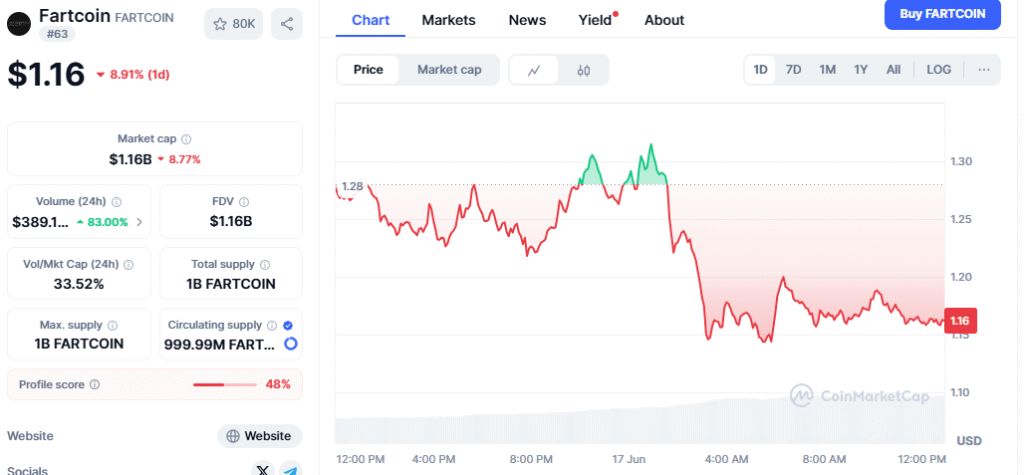

Fartcoin (FARTCOIN), a popular memecoin, has been on investors’ radar amid its volatile price swings and persistent struggle to break out of its current range formation. After trending higher in April and May, the token hit a resistance barrier around $1.5, where bullish momentum appeared to stall. Since then, Fartcoin has been locked in a sideways battle, raising the question: will this third attempt at a breakout finally succeed?

Despite a rebound from $0.92 to $1.47, the memecoin did not see strong buying pressure, suggesting a lack of conviction among traders. This muted demand has contributed to the formation of a trading range, limiting Fartcoin’s potential for a decisive rally. Analysts note that while the broader cryptocurrency market shows signs of strength—Bitcoin (BTC) remains comfortably above the $102,500 support level and is approaching its all-time highs—the memecoin has yet to follow suit in a convincing manner.

Also read: Bitcoin Set to Surge: Why a New All-Time High Is Imminent Amid Growing Market Momentum

Looking at the weekly chart, Fartcoin’s price action offers mixed signals. After a significant rally earlier this year that sent the token from lows of $0.21 to highs near $1.5, the price retraced those gains and has since been testing key resistance and support levels. The $1.5 mark has proven to be a tough ceiling, with recent attempts to break through being rejected. On the flip side, the psychological support level at $1.0 has held firm, providing a stable floor for the token. Meanwhile, the On-Balance Volume (OBV) indicator, which measures buying and selling pressure, has made higher highs compared to earlier this year—hinting at growing long-term investor interest despite the range-bound price.

On a daily timeframe, the picture remains cautious. After bouncing off the lows near $0.4, Fartcoin had been moving within an ascending channel, but recent rejections pushed it below this pattern, testing support near $0.92. This confirms the developing range-bound structure, with $0.9 emerging as a critical demand zone. However, the rebound from these lows to the $1.47 range highs has been marked by modest trading volumes, reflecting weak enthusiasm from buyers.

Without a meaningful surge in volume, the OBV remains flat, underscoring the memecoin’s struggle to build the momentum necessary for a breakout. For traders, this means the best approach remains watching the range extremes closely. A breakout in OBV—indicating renewed buying pressure—could be an early sign of a price breakout.

At the time of writing, Fartcoin’s Relative Strength Index (RSI) bounced off the neutral 50 level, defending mid-range support around $1.2. Swing traders eyeing short-term opportunities might consider entering near support levels with targets near the supply zone of $1.4 to $1.5.

In summary, while Fartcoin shows signs of resilience, the lack of heavy buying pressure means the memecoin faces an uphill battle in breaking free from its range. Whether the third breakout attempt will finally succeed remains to be seen, but for now, cautious trading and close attention to volume indicators remain paramount.