Ethereum Surges 10% as Gas Fees Drop—XRP Faces Resistance

More from the Author Jane Kariuki

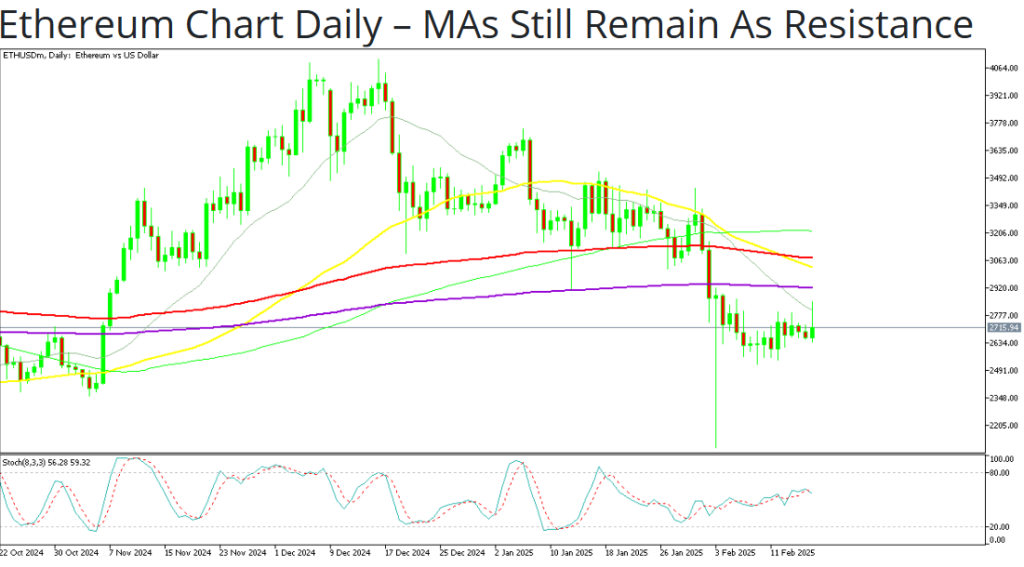

Ethereum’s price surged by 10% following a 70% reduction in gas fees, driven by improved network efficiency and an upcoming upgrade, while XRP struggled to maintain momentum after encountering resistance at the 50-day SMA.

The cryptocurrency market now watches closely for further developments, with Ethereum gaining confidence and XRP’s next move critical for its future prospects.

The cryptocurrency market is seeing a shift today as Ethereum (ETH) takes center stage with a significant price spike. The altcoin’s surge comes after a dramatic drop in gas fees, signaling a positive shift for Ethereum holders. Meanwhile, XRP has struggled to maintain upward momentum as it faces resistance at key levels.

Ethereum’s Gas Fee Reduction Sparks Optimism

Ethereum’s price jumped by 10% today, largely driven by a dramatic decrease in gas fees. Over the past week, Ethereum’s transaction costs dropped by nearly 70%, from $23 million to just $7.5 million per day. This decrease is the result of a higher gas cap, which allows for more transactions per block, improving overall network efficiency. As a result, Ethereum is becoming more attractive to both users and developers, increasing demand for the cryptocurrency.

The timing of the fee reduction coincides with Ethereum’s upcoming upgrade, “Pectra,” which is expected to be one of the most significant updates to the network. This, coupled with a decline in exchange-held ETH reserves (down by one million ETH in just 10 days), signals growing confidence in Ethereum’s long-term potential. Investors are opting to hold onto their assets, betting on Ethereum’s future growth.

Vitalik Buterin Calls for Further Gas Cap Increase

Ethereum co-founder Vitalik Buterin has suggested that the gas cap should be increased even further to ensure continued growth. By raising the gas limit, Buterin believes Ethereum can offer less censorship, reduced transaction costs across Layer-2 solutions, and a safety buffer in case of unexpected stress events. These changes could significantly improve Ethereum’s scalability and reinforce its dominance in the smart contract arena.

XRP Faces Resistance, Bulls Lose Steam

While Ethereum is soaring, XRP is facing challenges. The altcoin experienced strong bullish momentum last week, briefly breaking through the $2.25 to $2.55 range and peaking at $2.83. This rally was fueled by optimism surrounding a potential ETF approval for XRP. However, XRP failed to sustain its momentum, encountering resistance at the 50-day Simple Moving Average (SMA), which led to a price reversal back to $2.60.

Market watchers are keenly observing whether XRP can stabilize at this level or if the price will continue to dip. If XRP can regain momentum, a potential retest of the 50-day SMA might open the door to a breakout toward the psychological $3 mark. The outcome of this resistance test could determine XRP’s next major move in the market.

As Ethereum rises with its improved transaction efficiency, XRP’s future hinges on overcoming resistance and stabilizing its position in the market. Both coins are at pivotal points, and the coming weeks will reveal whether Ethereum’s dominance can continue and whether XRP can break through its barriers.

The post Ethereum Surges 10% as Gas Fees Drop—XRP Faces Resistance appeared first on Crypto News Focus.