- Despite a significant $153 million liquidity inflow, Ethereum‘s price remains stagnant, signaling strong selling pressure that could lead to a breakdown of its month-old support.

- This bearish outlook is reinforced by a substantial drop in Total Value Locked and declining Open Interest in futures, suggesting weakening market sentiment and potential further price depreciation.

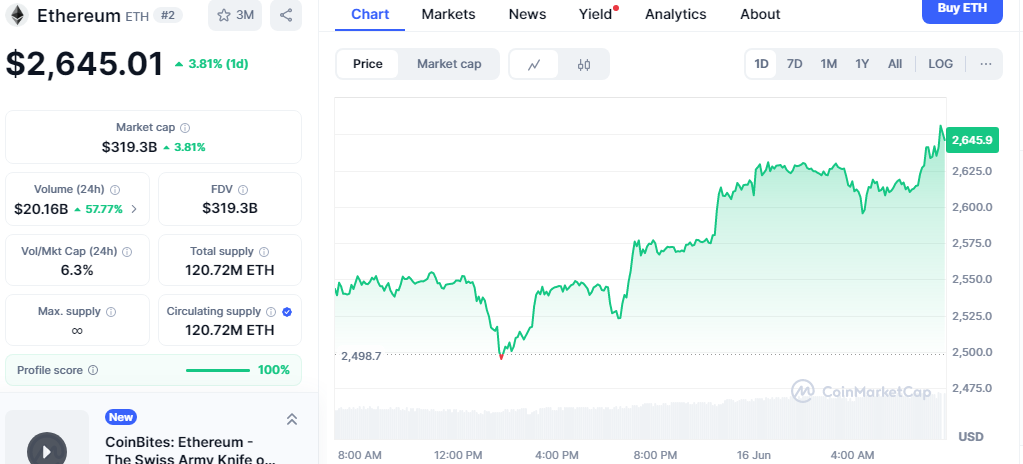

Ethereum (ETH) has demonstrated puzzling price stagnation over the past 24 hours, despite a substantial $153 million in liquidity flowing into the network, predominantly from Base. This perplexing inertia has raised concerns among market watchers, who are now pointing to a confluence of bearish indicators that could see the altcoin break its month-old support level.

While a significant net positive bridged flow typically signals bullish momentum, ETH has remained stubbornly flat, registering a 0.00% daily change at press time. This contradiction suggests that robust selling pressure is currently acting as a formidable counterweight, effectively neutralizing any upward thrust from the incoming liquidity.

Also read: Ethena ENA: Mellow Finance’s $4.48M Bet & Recovery Potentia

Adding to the unease is the precarious position of ETH’s price on the charts. After consolidating in a tight range since mid-May, the altcoin is now hugging its support line. Historically, this level has served as a springboard for upward price movements. However, analysts warn that the mounting bearish sentiment in the broader market could see this trend reverse, potentially leading to a notable price decline in the near future.

Further compounding the bearish outlook is the alarming drop in Ethereum’s Total Value Locked (TVL). According to DeFiLlama, TVL plummeted from $89.13 billion on June 11th to $84.53 billion at press time – a significant $4.6 billion exodus in less than 48 hours. This substantial withdrawal of capital underscores weakening market sentiment and raises the specter of further value erosion for ETH.

The derivatives market mirrors this dwindling interest. Analysis of ETH futures reveals a sharp decline in Open Interest, dropping from $41.43 billion to $34.66 billion. This $6.77 billion reduction suggests that traders are either scaling back their exposure or facing liquidations. Notably, long liquidations alone accounted for $29.56 million, indicating that bullish bets are being unwound. The sustained selling pressure and a decline in long positions could exert further downward pressure on Ethereum, potentially pushing its price to new lows.

As the crypto market braces for potential volatility, all eyes remain on Ethereum. The coming trading sessions will be crucial in determining whether the altcoin can defy the growing bearish undertow or succumb to a significant price breakdown.