- Ethereum has reclaimed the $2,500 level amid rising whale accumulation and a significant drop in exchange supply, signaling strong bullish momentum.

- Despite this, ETH remains range-bound as it awaits a decisive breakout above $2,850 or a breakdown below $2,100 to confirm its next major move.

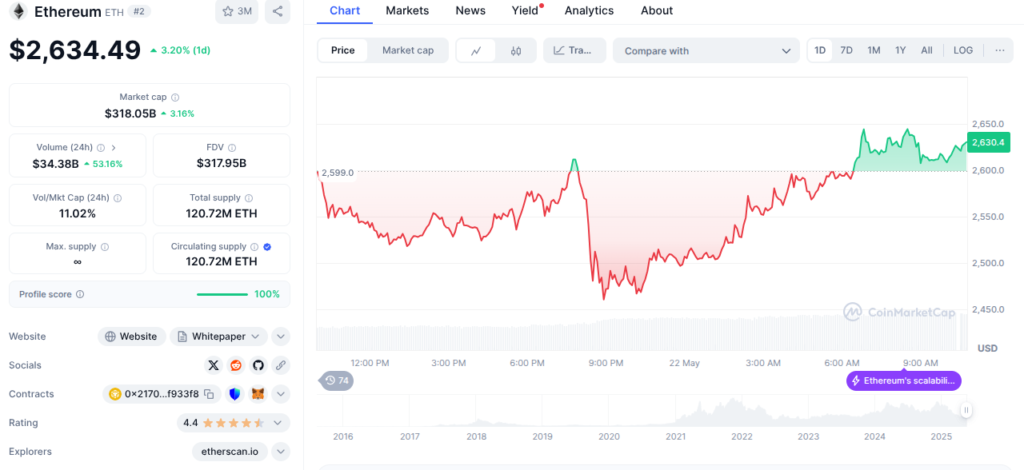

Current Ethereum Price: $2,580

Exchange Supply: Lowest since August 2024

Key Level: $2,500

Recent Whale Accumulation: 670,000 ETH in 9 days

Whale Activity and Exchange Supply Point to Growing Bullish Momentum

Ethereum (ETH) has reclaimed the $2,500 mark following a 2% price increase in the early Asian session on Thursday, a sign that bullish sentiment is gaining traction once again. This recovery is largely attributed to a significant decrease in ETH’s exchange supply and aggressive buying by whales—large holders who own between 10,000 and 100,000 ETH.

According to data from CryptoQuant, Ethereum’s supply on centralized exchanges has dropped to 18.73 million ETH, its lowest point since August 2024. This sustained downtrend, which began on April 24, reflects a long-term bullish trend, as ETH is increasingly moved off exchanges into private wallets—often considered a signal of accumulation and long-term holding intentions.

Also read: Ripple’s $11B Circle Acquisition Bid Signals Major Shift from XRP to Stablecoins

Over the past nine days, whale addresses have added a staggering 670,000 ETH, even as smaller retail holders distributed about 110,000 ETH. This divergence underscores a growing confidence among institutional and high-net-worth investors while retail sentiment remains comparatively cautious.

“Whales are doubling down on Ethereum, treating every dip as a buying opportunity,” noted a senior analyst at CryptoQuant. “This is exactly the kind of foundation a strong rally is built on.”

Ethereum Consolidates Around $2,500 as Market Awaits Clear Catalyst

Despite this influx of buying activity, Ethereum’s price action remains range-bound, hovering tightly around the $2,500 psychological level. While this consolidation may appear stagnant on the surface, it’s forming a potential springboard for ETH’s next major move.

ETH’s Futures Bubble Maps show increased trading volumes each time the price moves just above or below the $2,500 level, highlighting it as a pivot point of high interest for both bulls and bears. However, a lack of directional bias is keeping Ethereum in a holding pattern—for now.

Supporting this indecision is the Relative Strength Index (RSI), which remains flat and close to the overbought zone, signaling that buying momentum is showing signs of fatigue. Additionally, the MACD (Moving Average Convergence Divergence) is testing its signal line, with histogram bars on the verge of flipping negative—an early warning of rising downward pressure if confirmed.

Market watchers are closely observing two critical price levels:

- A breakout above $2,850 could propel ETH toward the $3,250 resistance.

- A breakdown below $2,100 might send Ethereum tumbling toward $1,688 support.

For now, Ethereum remains trapped within a $2,100–$2,850 range, with the $2,500 level acting as the battleground.

Retail Interest Lags Behind, Leaving Room for Further Growth

Interestingly, while institutional accumulation is heating up, retail excitement appears subdued. Google Trends data reveals that search interest for “Ethereum” has risen modestly from 45 on May 17 to 60, but still lags behind the 100-point surge seen during the May 8–9 rally. This divergence between on-chain bullish metrics and retail search volume suggests that ETH’s recent gains haven’t yet been driven by retail FOMO (fear of missing out).

This subdued retail presence may actually work in Ethereum’s favor. In past cycles, strong bull runs often began when retail sentiment was low, with institutional investors leading the charge. If the current whale-led accumulation continues and Ethereum clears technical resistance, retail buyers may re-enter the market, amplifying the move and creating a more explosive rally.

Ethereum Outlook: All Eyes on $2,850 Resistance

Ethereum’s near-term future hinges on whether the bulls can push the price convincingly above $2,850. A successful break would not only validate the accumulation trend but could also usher in a broader market rally, especially if ETH pulls other altcoins higher.

In contrast, failure to hold above $2,500, combined with weakening technical indicators, may result in a pullback toward $2,260 or even $2,100, where stronger support lies.

Still, with exchange balances at multi-month lows, whale accumulation ramping up, and modest retail participation, the underlying market dynamics remain favorable for Ethereum in the medium term. The only missing piece? A clear catalyst—possibly in the form of positive macroeconomic data, Ethereum staking upgrades, or broader altcoin recovery.

Until then, ETH traders and investors are best advised to keep an eye on the charts and exchange supply metrics, as these will likely dictate Ethereum’s next major move.

TL;DR:

- Ethereum has reclaimed $2,500, aided by aggressive whale buying and reduced exchange supply.

- Price remains range-bound, with $2,850 and $2,100 acting as key breakout and breakdown levels.

- Technicals show mixed signals; however, low retail interest and strong accumulation suggest potential for continued upward momentum.

- Technicals show mixed signals; however, low retail interest and strong accumulation suggest potential for continued upward momentum.