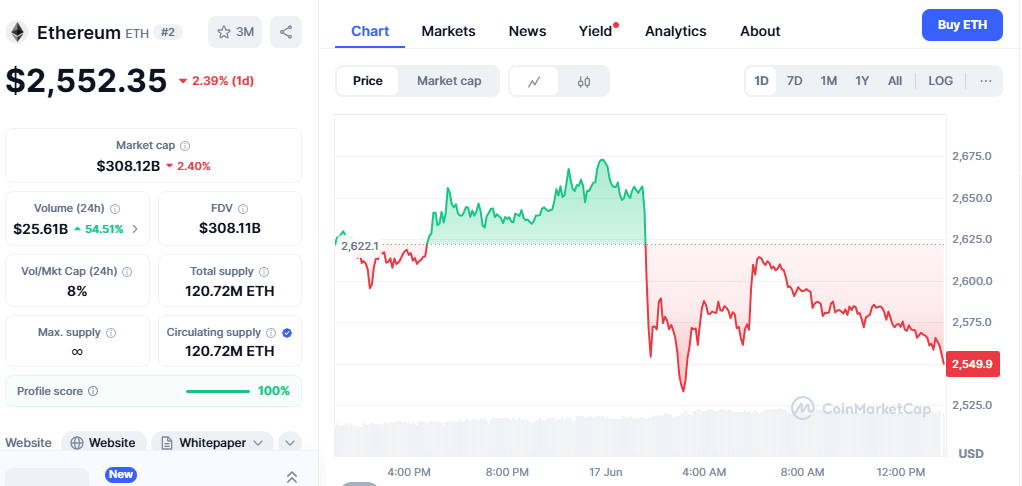

- Ethereum briefly rose above $2,600 on Monday as investor accumulation and ETF inflows fueled bullish sentiment.

- ETH exchange reserves dropped to an all-time low of 18.57 million, signaling reduced selling pressure.

Ethereum (ETH) resumed upward momentum on Monday, buoyed by robust ETF inflows and a significant shift in investor behavior. The second-largest cryptocurrency by market capitalization briefly crossed $2,600, following a marked drop in exchange reserves and a growing trend toward accumulation. As of Tuesday, ETH is trading around $2,570.

Exchange reserve data from CryptoQuant shows Ethereum holdings on centralized platforms fell to an all-time low of 18.57 million ETH, down from 18.72 million over the weekend. This decline typically signals reduced selling pressure and increased investor confidence in long-term holdings.

Also read: PEPE Price at Risk as Whale Activity Increases Near Key Support Leve

Institutional appetite further reinforced the bullish narrative. According to CoinShares, Ethereum investment products posted $583 million in net inflows last week — the strongest showing since December 2024. US spot ETH ETFs alone saw $528.12 million in inflows, extending a 19-day streak that ended with modest $2.18 million outflows amid geopolitical tensions.

“The ecosystem fundamentals remain strong, with rising stablecoin activity and the upcoming Pectra upgrade,” said Tracy Jin, COO of crypto exchange MEXC. “Nearly half of all stablecoins operate on Ethereum, and upcoming staking rules and ETF developments are improving investor sentiment.”

Despite these bullish undercurrents, Jin remains cautiously optimistic, forecasting an ETH price between $2,800 and $3,600 by year-end — contingent on the pace of network upgrades and regulatory clarity.

Still, ETH’s technical outlook suggests near-term caution. The asset tested resistance at its 200-day Simple Moving Average (SMA) and was rejected, while futures markets recorded $134 million in liquidations over the past 24 hours. ETH continues to hold above the $2,500 support, but a decisive break above the 200-day SMA is needed to target the next key resistance at $2,850.

Failure to sustain $2,500 could lead to a retreat toward the $2,260–$2,110 support range, especially if broader market sentiment weakens.

Momentum indicators present mixed signals. The Relative Strength Index (RSI) is trending above neutral, while the Stochastic Oscillator remains below. A bullish crossover in both could reinforce upward pressure in the short term.

While Ethereum’s fundamentals and institutional backing remain solid, traders are watching technical levels closely as ETH navigates a pivotal range.