- Ethereum has dropped to $2,476 after facing strong rejection at $2.7K, with rising sell pressure from both whales and retail traders signaling a bearish trend.

- Key support lies at $2.2K, and a failure to hold this level could trigger a deeper correction toward $2K.

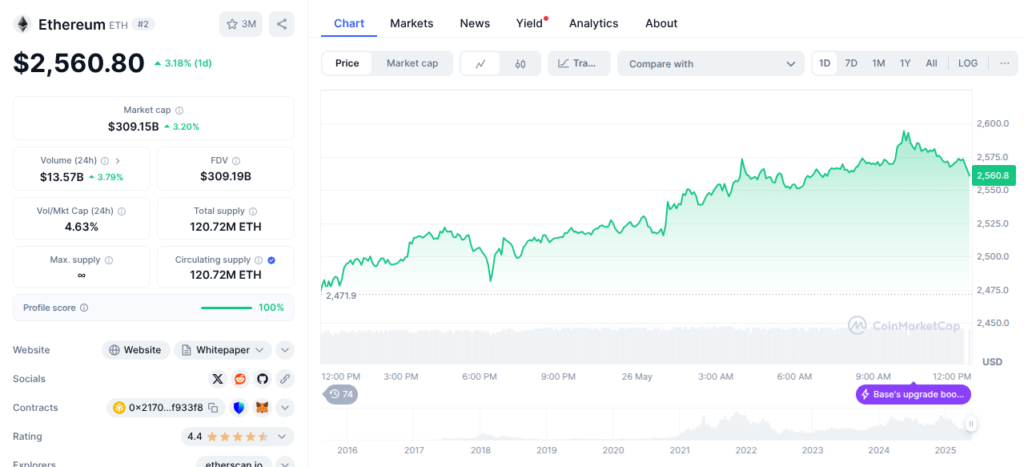

Ethereum [ETH] has taken a sharp downturn after a short-lived rally to $2,700 earlier this week. The world’s second-largest cryptocurrency slipped to $2,476 at press time, marking a 3.05% decline in the past 24 hours.

The rejection at the $2.7K resistance level has triggered a wave of selling, evident across both spot and derivatives markets. According to data from CryptoQuant, the 14-day Moving Average of Ethereum’s Taker Buy-Sell Ratio plummeted—indicating an aggressive influx of sell orders overshadowing buy demand.

Also read: Unstaked Crypto Presale Nears $7M with $1M Giveaway Live — TON Dips, PEPE Eyes Bullish Breakout

Adding to bearish sentiment, IntoTheBlock data revealed that Ethereum whales are actively offloading their holdings. The Large Holder Netflow flipped negative, with over 188.6K ETH sold, resulting in a net outflow of -12.7K ETH in a single day. This shift suggests even long-term investors are trimming their positions, amplifying downward pressure.

Retail sentiment mirrors this trend. Spot market activity shows a significant imbalance: 113.1K ETH were sold compared to 90K bought over the past day, creating a negative delta of 22.53K. This pattern underscores a strong sell-side dominance as investors race to lock in profits or cut losses.

Now, eyes are on the next critical support zone: $2,200. If ETH fails to hold this level, the door opens for a possible retest of the psychological $2,000 mark. Conversely, maintaining above $2.2K could indicate a short-term consolidation range before potential bullish momentum resumes.

While the market appears overwhelmed by sellers, some analysts caution against panic. If the ongoing decline is largely driven by short-term traders—often dubbed “weak hands”—it might signal a healthy correction within a broader bullish structure.

Still, with whales exiting and sell pressure rising, Ethereum’s immediate outlook leans bearish. Traders and investors should monitor price action closely around the $2.2K support level, as it may determine ETH’s direction in the coming days.