- Mellow Finance’s recent $4.48 million investment in Ethena (ENA) signals strong institutional confidence, coinciding with positive shifts in ENA’s derivative markets and renewed buy interest.

- This strategic move could be the catalyst for ENA’s recovery, but its sustained success will depend on traders’ conviction and their ability to navigate key liquidation levels.

In a bold move that has set tongues wagging across the crypto landscape, Mellow Finance has made a significant bet on Ethena [ENA], withdrawing a hefty 15.147 million ENA tokens, valued at $4.48 million, from the Bybit exchange. This substantial acquisition marks Mellow Finance’s inaugural foray into altcoin investments, raising the critical question: can this calculated gamble ignite ENA’s recovery amidst recent market corrections?

Mellow Finance’s timing is particularly noteworthy. Their decision to accumulate ENA during a broader altcoin downturn suggests a strong belief in Ethena Labs’ underlying fundamentals and a perception that ENA is currently undervalued. This move could be interpreted as a powerful vote of confidence from institutional players, potentially instilling much-needed hope in a market grappling with sustained underperformance among altcoins.

Also read: Bitcoin Price Prediction: Whale’s $200M Bet vs. $1B Shorts – BTC’s Next Move?

Further bolstering the optimistic outlook are recent shifts observed in ENA’s derivative markets. After a prolonged period of negative funding rates throughout April, a significant reversal has occurred. Funding rates across major platforms, including Bitmex, Hyperliquid, and Bybit, have rebounded into positive territory. This pivotal shift indicates that traders are now willing to pay to maintain long positions, a clear sign of renewed bullish sentiment.

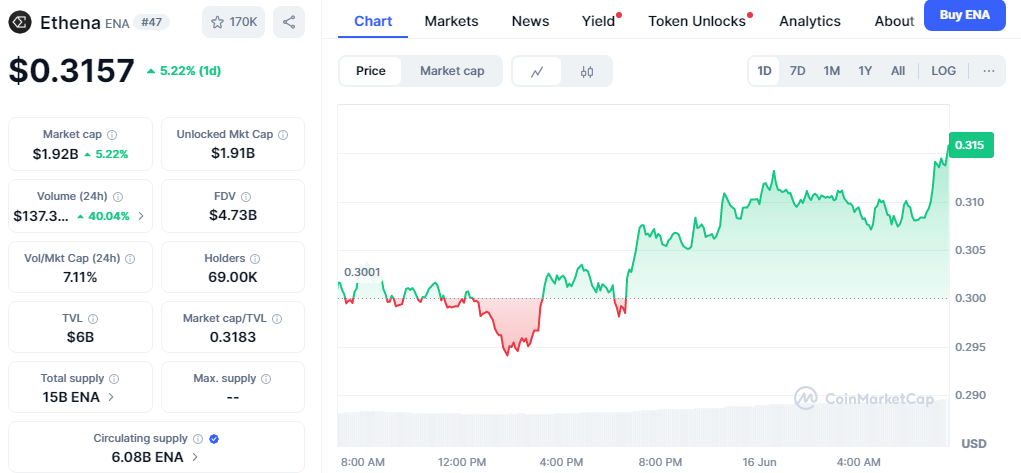

Adding to this positive momentum, the Aggregated Orderbook Liquidity Delta for ENA has also surged back into positive figures, reaching approximately $551.46K. This inflow, particularly around the $0.29-$0.30 price range, suggests a cautious yet definite resurgence of buy interest. The prevalence of green delta bars across the order book further underscores this renewed appetite for ENA, potentially establishing a short-term price floor around the $0.30 mark.

However, the road ahead is not without its potential pitfalls. Analyzing the Binance ENA/USDT Liquidation Heatmap reveals crucial risk zones to monitor. A substantial $262K in liquidation leverage exists below the $0.28 level, which could serve as a short-term support if bulls manage to defend it. Conversely, a cluster of short liquidations above $0.30 presents an opportunity for a potential short squeeze should the price manage to break through this resistance.

Ultimately, ENA’s immediate future hinges on how traders respond to these critical levels. Mellow Finance’s substantial investment has undoubtedly injected a dose of optimism into the ENA ecosystem. Whether this audacious bet proves to be a catalyst for a sustained recovery or merely a temporary reprieve will depend on the conviction of traders and their willingness to drive the price upwards. The coming days will reveal whether ENA can leverage these positive signals to spark a genuine turnaround.