- Dogecoin weekly ADX pattern is mirroring its 2020 setup, suggesting a potential breakout that could push prices as high as $4.50.

- However, a low MVRV score and broader macroeconomic conditions indicate the altcoin market may still be in early stages of recovery.

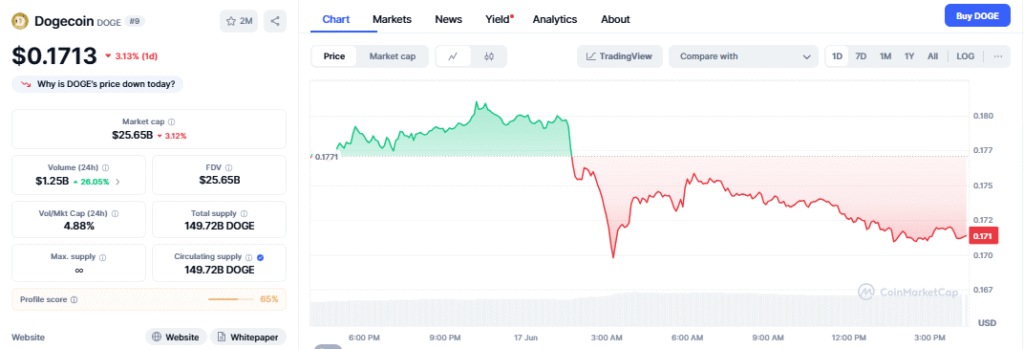

Dogecoin (DOGE) is capturing renewed attention among analysts, as a familiar technical pattern emerges that last preceded its meteoric 2021 rally. Despite a 2.22% dip in the past 24 hours and a 9.08% decline over the last week, experts point to signs that the meme coin may be laying the groundwork for a significant upward move.

At the center of this speculation is the Average Directional Index (ADX), a trend strength indicator. According to crypto analyst Tardigrade, Dogecoin’s weekly ADX is currently tracing a structure eerily similar to the setup that developed between 2019 and 2020 — just before dogecoin surged from $0.0025 to nearly $0.70 in less than six months.

Also read: Cardano (ADA) Price Prediction: Analyst Signals Bullish Reversal Ahead

Tardigrade’s analysis reveals that the ADX first launched from a low, then formed two mid-level peaks, followed by a dip to a lower low — precisely the pattern playing out again in 2024. In this cycle, the ADX climbed when DOGE hit $0.22 in May and $0.46 in December 2024. Following a brief pullback, the ADX is once again on the rise, suggesting an imminent trend reversal.

A projected blue circle on Tardigrade’s chart symbolizes a potential breakout zone. If history repeats itself, that breakout could drive DOGE prices toward $4.50 — representing a staggering 2,491% increase from current levels around $0.17.

However, not all indicators are as bullish.

A separate analysis by a crypto commentator known as Kevin highlights Dogecoin’s Market Value to Realized Value (MVRV) ratio, which remains at just 3.5 — well below the peaks of 11 in 2017 and 16 in 2021. The MVRV ratio, often used to assess market tops and bottoms, suggests DOGE may still be in bear market territory.

Kevin attributes the lackluster performance to ongoing restrictive monetary policies and the aftereffects of post-pandemic economic recalibration. According to him, these macro factors have dampened the momentum of altcoins across the board.

Still, he believes the tide will turn eventually, advising investors to seek value entries rather than chase euphoria.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making investment decisions.