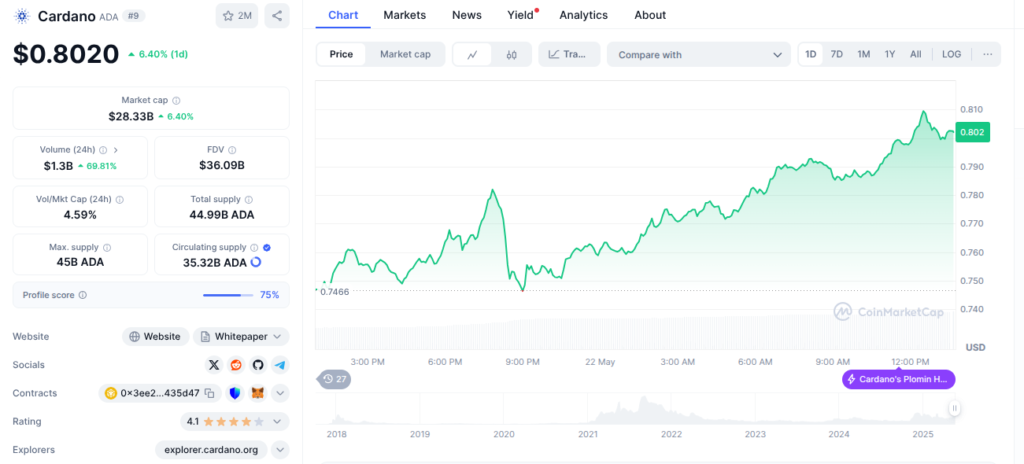

- Cardano (ADA) has flipped key resistance at $0.75 into support, with bullish momentum on both daily and 4-hour charts suggesting a potential rally toward $0.90.

- However, sustained demand and a breakout in Bitcoin are crucial to confirm ADA’s upward move.

After weeks of sideways consolidation and volatile price action, Cardano (ADA) has finally delivered a technical breakout that could be the start of a much-anticipated rally. The $0.75 level, a critical resistance for ADA, has been reclaimed as support, and both the 1-day and 4-hour charts show bullish structures forming.

With Bitcoin (BTC) poised near its all-time high, market sentiment could quickly turn euphoric — and Cardano is in a position to benefit. But is ADA truly ready to target $0.90, or are traders being lured into another fakeout?

Let’s examine the data and technical signals supporting the current bullish case for Cardano.

ADA Flips Key Resistance to Support: What It Means for the Bulls

Cardano’s recent breakout above $0.75 marks a significant development in its price trajectory. This level had served as a swing high in mid-March during a sharp decline from $1.15 to $0.55. Reclaiming it now not only signals the end of that bearish chapter but also sets the stage for a potential continuation toward the next major resistance at $0.90.

Also read: XRP Price Prediction May 23: Will Bulls Break the $2.42 Resistance and Ignite a Rally?

On the daily chart, ADA previously dropped below a long-standing range support of $0.69. However, bulls swiftly reclaimed this level in early May. Since then, momentum has been building steadily, with the price pushing through a series of higher lows and higher highs.

The daily RSI (Relative Strength Index) bounced off the neutral 50 line, signaling a shift in momentum toward buyers. Meanwhile, the OBV (On-Balance Volume) has been climbing, suggesting consistent accumulation and increasing demand behind the scenes.

Market structure, both in the broader timeframe and within sub-structures, now leans decisively bullish. This technical alignment strengthens the case for ADA’s continued move higher.

4-Hour Chart Confirms Short-Term Bullish Momentum

Zooming into the 4-hour timeframe, the bullish narrative continues to hold weight. ADA’s recovery from the recent low of $0.72 was pivotal. More importantly, it broke through a descending trendline resistance and invalidated the prior lower high at $0.743.

The RSI has surged above 50, once again reinforcing the idea that momentum has flipped in favor of buyers. The OBV on this shorter timeframe is also on an upward trajectory, mirroring the accumulation trend seen in the daily chart.

Key swing points have now been established, particularly the $0.648 support and the swing high at $0.84. If bulls maintain control, a retest of the $0.84 level is likely — and a clean break above it would open the door for a rally to $0.90 and beyond.

That said, ADA’s short-term strength remains partly dependent on broader market dynamics, particularly Bitcoin’s performance.

Watch the Volume and Bitcoin’s Next Move

Despite the promising setup, ADA’s next leg up to $0.90 isn’t guaranteed. Volume and market participation are key components of a successful breakout. At press time, Cardano’s long/short ratio stands at 0.97, suggesting a slight bias toward long positions. However, the taker buy volume hasn’t been strong enough to show dominant bullish conviction among large traders.

CoinGlass data shows most accounts remain positioned long, but their average position sizes may be small — indicating a lack of aggressive leverage and potential hesitancy in the market.

Bitcoin is currently hovering near its all-time high of $108.7K. Should BTC break above this level, it could trigger a wave of bullish momentum across the altcoin market — a scenario where ADA could easily ride the tide to test the $0.90 mark.

On the flip side, if BTC faces resistance and reverses, ADA’s momentum could stall. Therefore, ADA traders must keep a close watch on Bitcoin’s price action.

Final Thoughts: $0.90 in Sight, but With Conditions

XRP Price Prediction May 23: Will Bulls Break the $2.42 Resistance and Ignite a Rally?

bulls have laid the groundwork for a continuation rally. The breakout above $0.75, the bullish shift in market structure, and the strengthening technical indicators all point to upward potential. A retest of the mid-range resistance at $0.90 appears to be the next logical target.

However, the breakout must be accompanied by increasing volume and stronger buy-side pressure. Without that, the current rally could lose steam quickly.

In the short term, ADA’s bullish case hinges on:

- Sustained demand (as shown by rising OBV and RSI)

- A decisive move by Bitcoin above its all-time high

- Increasing trading volume to support a breakout

Should these factors align, Cardano could be well on its way to reclaiming the $0.90 level — and perhaps setting its sights even higher.

Key Levels to Watch:

- Support: $0.75, $0.69

- Resistance: $0.84, $0.90

- Breakout Confirmation: High volume above $0.84

- Invalidation Point: Drop below $0.72