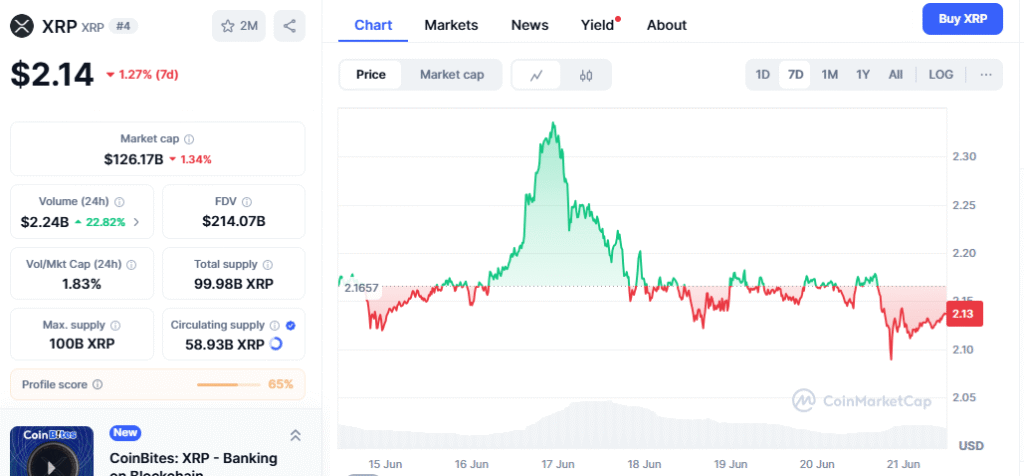

- Canada’s first spot XRP ETF, launched by Purpose Investments, has struggled post-launch, mirroring weak XRP market performance and limited trading activity.Meanwhile, U.S.

- regulatory progress on potential XRP ETFs could provide a future catalyst, as XRP’s long-term bullish trend remains intact despite short-term pressures.

Canada’s first spot XRP exchange-traded fund (ETF), the Purpose ripple ETF (XRPP.U), has had a challenging start on the Toronto Stock Exchange (TSX) since its launch on June 18. The ETF, which follows Brazil’s Hashdex ripple ETF as the world’s second spot ripple offering, has trended lower in its initial trading days, mirroring broader XRP market struggles.

By the close of trading on Friday, June 20, XRPP.U had slipped 1.63% to $9.68, with light trading volume keeping it near session lows. The fund, which is also available in CAD-hedged (XRPP) and CAD non-hedged (XRPP.B) versions, has struggled to gain upward momentum amid bearish sentiment surrounding the ripple token itself.

Also read: How Much XRP You Need to Retire by 2040: Potential Profits and Key Price Targets

Brazil’s Hashdex ripple ETF has followed a similar path, down roughly 7.5% since its debut. The weak performance across these products underscores broader softness in the XRP market, which has seen limited investor appetite in recent weeks.

With a management fee of 0.69%—capped at 0.89%—Purpose’s ETF offers Canadian investors regulated crypto exposure within tax-efficient accounts like TFSAs and RRSPs. However, the Canadian and Brazilian markets remain relatively small compared to the U.S., limiting the global impact of these ETFs on ripple price.

Investor attention is now shifting toward potential U.S. XRP ETFs. The Securities and Exchange Commission (SEC) has invited public comments on proposed spot XRP and Solana ETFs from Franklin Templeton and WisdomTree. If approved, these products would list on Cboe’s BZX Exchange and could provide the liquidity boost and institutional participation that XRP has so far lacked in the North American market.

XRP Price Outlook: Technical Signals Remain Mixed

At press time, rippletraded at $2.13, down nearly 1% on the day and about 1.7% over the past week. The token currently sits below its 50-day simple moving average (SMA) of $2.30, highlighting near-term bearish pressure. However, with prices holding well above the 200-day SMA of $1.85, ripple ’s long-term bullish trend remains intact, offering cautious optimism for investors eyeing a potential rebound.