- BNB Chain’s recent Maxwell upgrade and rising DEX activity are strengthening its fundamentals, with developer interest also starting to recover.

- However, negative funding rates and the risk of a long squeeze mean BNB’s price breakout is uncertain despite growing whale activity.

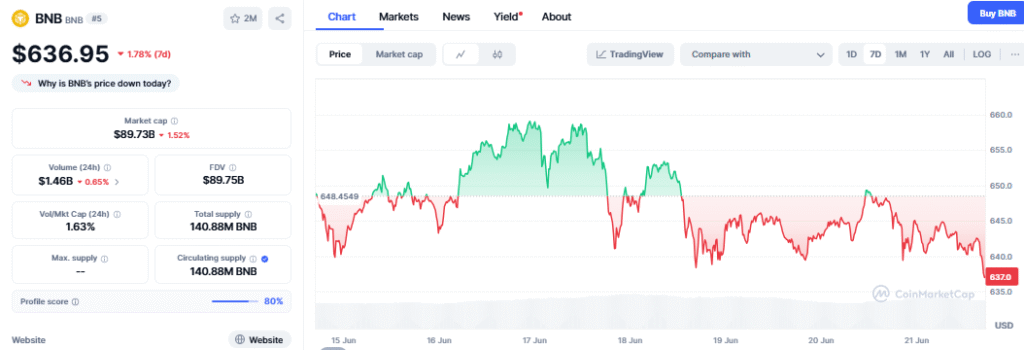

Binance Chain’s native token BNB is gaining renewed attention after a series of impactful network upgrades. Yet, the big question remains: Can these improvements translate into a sustainable price rally?

Network Strength Improving with Key Upgrades

The recent Maxwell upgrade to the Binance Smart Chain [BNB Chain] reduced block times to just 0.75 seconds—delivering faster transaction speeds and improved network reliability. Coupled with a growing ecosystem now supporting over 5,600 decentralized applications (DApps) and $27.54 billion in weekly decentralized exchange (DEX) volume, the fundamentals of the network appear stronger than ever.

In addition, Binance continues backend improvements, highlighted by a scheduled maintenance window this week, aimed at ensuring long-term network stability.

Also read:Ethereum (ETH) Price Prediction: How a 15x Stablecoin Surge Could Drive Major Gains

Developer Interest Shows Signs of Recovery

Development activity on BNB Chain has also been ticking upwards, with contributions rising to 2.95 after touching multi-week lows in May. This slow but steady rebound suggests growing developer interest, particularly after the Maxwell upgrade. If this momentum continues into late June, it could mark the beginning of a more robust growth cycle for the network.

Retail Traders Growing Bullish—But Caution is Warranted

Sentiment among retail traders is tilting bullish. On June 20, the long/short ratio stood at 1.74, with 63.45% of traders positioned long on BNB. This signals optimism for a price rebound following recent network progress.

However, such a skew toward long positions raises the risk of a sudden long squeeze if market conditions shift unexpectedly. Furthermore, despite this retail enthusiasm, funding rates on Binance Futures remain negative at -0.007%—highlighting lingering caution among leveraged traders.

Whale Activity Suggests Strength, But Follow-Through Is Key

Interestingly, large traders and whales appear more active, with average order sizes remaining high and taker buy volumes showing dominance in recent sessions. This hints at growing confidence among professional traders. However, for this to trigger a true breakout, sustained buying pressure is required over the coming days.

Will BNB’s Upgrades Spark a Price Breakout?

BNB Chain is clearly strengthening across both utility and infrastructure, with improving DEX volumes, developer engagement, and whale activity. Yet, mixed signals in leveraged markets and the potential for volatility mean that price gains are not yet guaranteed.

If whale buying continues and market confidence builds, BNB could soon break out of its current consolidation range. For now, traders should watch closely to see whether network growth will translate into a lasting upward move on the charts.