- BNB is outperforming most top altcoins, trading just 17% below its all-time high thanks to strong fundamentals, rising staking demand, and tight supply.

- Its smart tokenomics—driven by regular burns and limited circulation—are helping it defy the broader market downtrend.

Market Divergence: BNB’s Resilience Shines Through

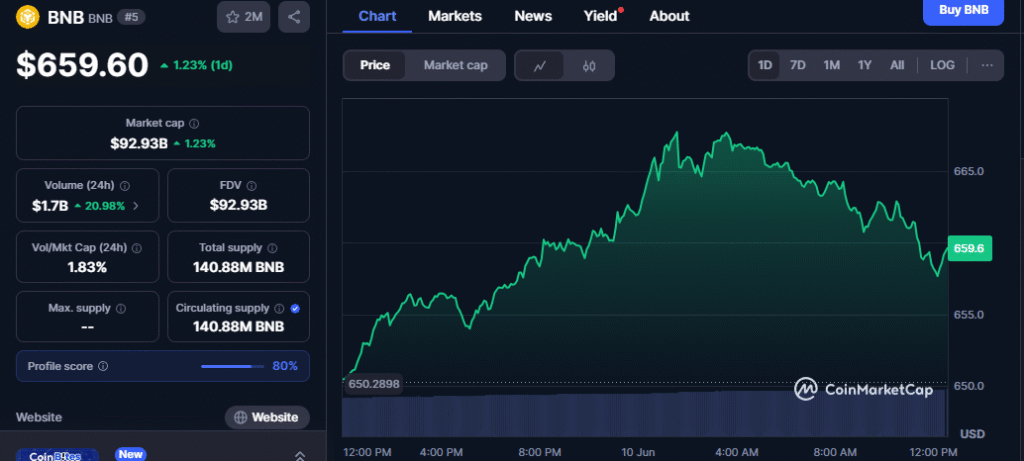

While many top-tier cryptocurrencies remain well below their all-time highs, Binance Coin (BNB) is staging a quiet comeback. At press time, BNB was trading just 17% below its peak—an impressive feat when most large-cap assets like Ethereum and Solana were down over 40%. In fact, BNB has already surpassed the $700 mark twice in 2024, hitting a record high of $793 in December.

This remarkable market divergence isn’t coincidental. BNB’s fundamentals—liquidity, staking demand, and capital inflows—paint a picture of strength. Total Value Locked (TVL) recently hit a three-year high of over $6 billion, while stablecoin supply is at a two-year peak. The data indicates substantial sidelined capital ready to flow into BNB. Meanwhile, derivatives markets remain relatively calm, suggesting this momentum isn’t built on speculative leverage.

Also read: Ethena Price Stalls at $0.295 After $21M Whale Transfer: Volatility Looms – What’s Next for ENA?

Smart Tokenomics Are Fueling the Climb

BNB’s edge lies in its well-designed tokenomics. Starting with a supply of 200 million tokens, Binance has committed to halving it through quarterly token burns. So far, over 60 million BNB have been permanently removed from circulation, and the goal remains to reduce the supply to just 100 million.

Each burn event typically eliminates between $800 million and $1 billion worth of tokens, depending on market prices. Combine this with the fact that a large portion of BNB is staked or locked within the Binance ecosystem, and the circulating supply becomes even tighter. This scarcity is playing a significant role in propping up BNB’s value, especially when compared to other high-cap coins with bloated supplies.

BNB’s Breakout Potential Still Intact

BNB’s performance is not just a reflection of market momentum—it’s also the result of deliberate and disciplined supply control. While most of the market is in recovery mode, BNB’s strong fundamentals and tokenomics position it as a standout.

With a growing investor base, surging staking interest, and regular token burns, Binance Coin may well be on track to retest—and possibly surpass—its all-time high in the near future. In a market full of noise, BNB’s quiet strength is speaking volumes.