- Despite global geopolitical tensions, particularly in the Middle East, Bitcoin continues to demonstrate remarkable resilience, with every dip attracting new buyers and suggesting a strong upward trajectory towards previous highs.

- This consistent buying pressure, even amid external turmoil, highlights Bitcoin’s growing maturity and its potential as a robust, decentralized asset.

In a global landscape fraught with geopolitical tensions, particularly escalating conflicts in the Middle East, Bitcoin (BTC) continues to exhibit remarkable resilience, attracting a consistent wave of buyers on every dip. This phenomenon suggests a strong underlying bullish sentiment, with market participants eyeing a return to previous highs.

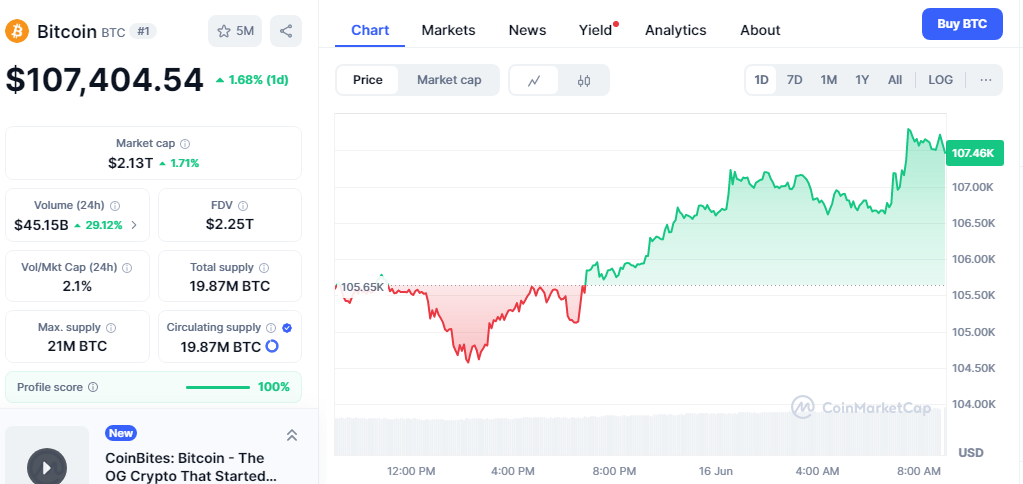

Despite what has been described as “noisy trading,” the cryptocurrency has demonstrated a clear propensity for upward movement. Early Monday trading saw Bitcoin rally, further cementing the notion that support levels are holding firm. The $105,000 mark, an area that has historically proven significant, is currently under close observation by traders. Its continued stability bodes well for Bitcoin’s immediate future, potentially paving the way for a push towards the $110,000 psychological barrier.

Also read:SUI & SOL Token Unlocks: Is a Crypto Price Drop Imminent?

Should Bitcoin successfully breach the $112,000 resistance level, analysts predict a more substantial and sustained uptrend, signaling a broader market shift. Conversely, a retreat from current levels would likely see the 50-day Exponential Moving Average (EMA) step in as immediate support. A break below this would then bring the key $100,000 level into play.

What remains particularly striking is Bitcoin’s steadfast performance amidst the backdrop of ongoing Middle East conflicts. Traditional markets often react with significant volatility to such geopolitical instability, yet Bitcoin has largely held its ground. This unexpected resilience is being interpreted by many as a powerful signal of Bitcoin’s growing maturity and its potential role as a robust, decentralized asset in times of global uncertainty. The consistent buying pressure, even in the face of external headwinds, underscores a profound confidence in Bitcoin’s long-term value proposition.