- Bitcoin position appears fragile as whale accumulation drops 191%, funding rates remain bearish, and on-chain valuation metrics flash warning signs.

- Without stronger demand, BTC could face heightened downside risks despite holding near its all-time highs.

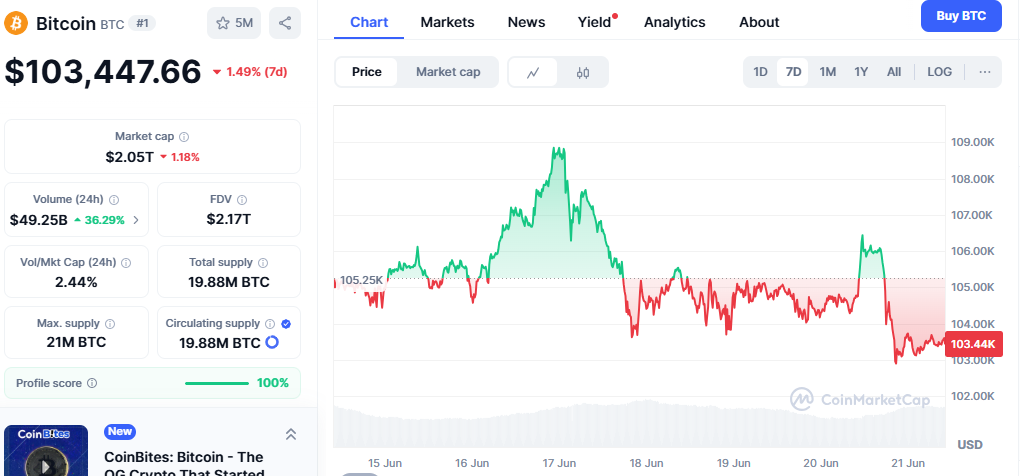

Bitcoin [BTC] price has hovered around $106,000 recently, but despite flirting with its all-time highs (ATH), the market shows increasing signs of fragility. Several on-chain and derivatives metrics suggest that BTC’s current position may be more vulnerable than it appears.

One notable shift has been in whale behavior. According to IntoTheBlock, Bitcoin’s Large Holders Netflow plunged by 191% over the past week. This marks a sharp reduction in whale accumulation, which had remained neutral through April and May but turned decisively bearish in June. Without strong inflows from these key market players, BTC could face heightened downside risk.

Also read: Shiba Inu vs Pepe: Which Meme Coin Will Explode First in the 2025 Crypto Rally?

Another red flag comes from the derivatives market. Persistent negative funding rates on dYdX indicate that many traders are betting against a breakout. Attempts by longs to reverse the trend have repeatedly failed, leaving Bitcoin exposed to speculative sell-offs unless sentiment improves.

At the same time, Bitcoin’s realized profits (7DMA) have dropped below $1 billion—levels last seen in late October 2024—despite BTC recently hitting a local high. This subdued profit-taking aligns with a weakening demand backdrop, increasing the odds of a directional shift.

The MVRV Z-score, which measures unrealized profits, has also declined to 2.47 from 2.97 earlier this month. With fewer unrealized profits to rely on, especially among short-term holders, the incentive to hold may be fading.

On-chain valuation models present additional concerns. Both the NVT and NVM ratios have surged—by 37.78% and 27.45%, respectively—indicating a growing disconnect between Bitcoin’s market cap and network utility. Historically, such divergences have often preceded corrections or sideways movement.

Finally, Bitcoin’s Stock-to-Flow (S2F) ratio has dropped by 16.66%, suggesting weakening perceived scarcity—a key pillar of the post-halving bullish narrative.

In short, while Bitcoin has maintained a neutral stance for now, falling whale activity, bearish sentiment in derivatives, and stretched valuations suggest that its position may be at risk. Traders and investors should closely monitor these signals for clues on BTC’s next big move.