Bitcoin Shows Signs of Recovery as Whale Selling Slows

More from the Author Cal Evans

Bitcoin has faced significant declines over the past month, but recent data suggests a potential recovery as whale selling pressure on Binance decreases, signaling possible price stabilization.

With Binance maintaining dominance in both spot and futures markets, reduced whale activity could pave the way for Bitcoin’s rebound.

Bitcoin’s price trajectory has been volatile in recent weeks, with the cryptocurrency experiencing significant declines over both weekly and monthly timeframes. However, fresh data suggests a potential turnaround as selling pressure from major investors, or ‘whales,’ appears to be easing.

Bitcoin’s Recent Performance

Over the past week, Bitcoin has suffered an 8.4% decline, while its monthly performance shows a sharper drop of 16.2%. Despite this extended downturn, the past 24 hours have shown a glimmer of hope, as Bitcoin’s price edged upward to $81,647. This modest recovery has sparked renewed interest from analysts examining market trends and whale activity to gauge whether the worst of the correction is over.

Whale Activity on Binance: A Key Indicator

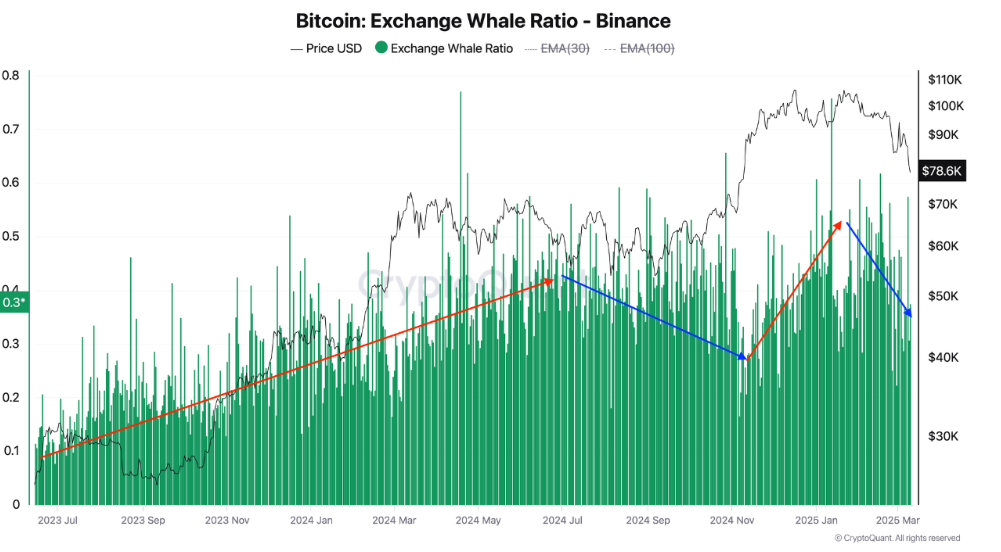

A crucial factor influencing Bitcoin’s price movements is the activity of large-scale investors on Binance, the world’s largest cryptocurrency exchange. Analysts have been closely monitoring the Bitcoin Exchange Whale Ratio, a metric that measures the proportion of large inflows to total exchange inflows.

CryptoQuant analyst Darkfost reports that the whale ratio on Binance has been decreasing, signaling reduced selling pressure from large Bitcoin holders. Historically, a decline in whale selling activity has often preceded market rebounds, suggesting that Bitcoin could be approaching a more stable phase or even a potential price recovery.

Binance’s Market Dominance and Its Impact

Another key factor influencing Bitcoin’s price is Binance’s continued dominance in both spot and futures markets. According to analyst Crazzyblockk, Binance currently controls 45.5% of the USDT futures market and holds a 35% share of total spot trading volume. As a result, trends emerging from Binance often set the tone for broader market movements.

Binance’s liquidity and high trading volume mean that any shift in whale behavior on the platform can have significant implications for Bitcoin’s price trajectory. If the current trend of reduced whale sell-offs persists, it could reinforce Bitcoin’s chances of stabilizing and potentially rebounding in the near term.

Is Bitcoin Ready for a Comeback?

While the long-term outlook for Bitcoin remains uncertain, the latest data suggests that selling pressure may be waning, offering a possible path to recovery. A continued decline in the whale ratio, coupled with Binance’s dominant role in market liquidity, could help Bitcoin regain lost ground.

For traders and investors, monitoring these key metrics remains essential as Bitcoin navigates its next move in the ever-volatile cryptocurrency landscape.

The post Bitcoin Shows Signs of Recovery as Whale Selling Slows appeared first on Crypto News Focus.