- Aguila Trades, Bybit’s top trader, has made a high-stakes $200 million bet on Bitcoin with 20x leverage, creating a dramatic showdown against $1 billion in short positions.

- The coming days will be critical as BTC either pushes towards new highs by triggering a short squeeze or faces a sharp correction if key support levels fail, potentially leading to significant liquidations.

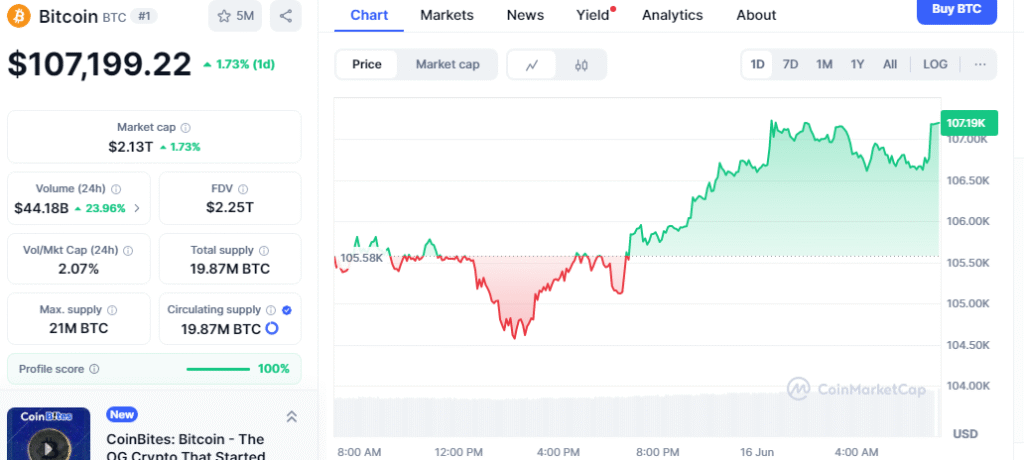

The cryptocurrency market is abuzz with speculation as a prominent Bitcoin [BTC] whale, known as Aguila Trades, has plunged $200 million into a highly leveraged long position, setting the stage for a potential market-defining moment. This audacious move comes amidst a staggering $1 billion in short positions stacked against Bitcoin, creating a dramatic tug-of-war that could propel BTC to new all-time highs or trigger a painful cascade of liquidations.

Aguila Trades, recognized as Bybit’s top trader with an impressive 365-day Profit & Loss (P&L) of $77.36 million and a 36.45% ROI, is no stranger to bold plays. Despite a recent $12.47 million loss on a previous Bitcoin long, their latest bet is even more aggressive: a 20x leveraged long on 1,894 BTC. Such high leverage amplifies both potential gains and losses, turning even minor price fluctuations into significant swings.

Also read: XRP ETF Crash: Brazil’s XRPH11 Plummets 20%+ as Hype Fades

The crucial question now revolves around Bitcoin’s immediate price action. Liquidation maps reveal a critical zone for long positions between $103.8K and $104K, where approximately $700 million in leveraged longs reside. A dip below this threshold could trigger a domino effect of liquidations, placing Aguila’s substantial bet at severe risk.

Conversely, a massive cluster of short positions, totaling nearly $1 billion, lies between $106.5K and $107K. If Bitcoin can breach this resistance, it could ignite a “short squeeze,” forcing bearish traders to buy back BTC to cover their positions, thereby fueling a rapid ascent and potentially benefiting high-leverage longs like Aguila’s.

Adding to the complexity, the MVRV Pricing Bands provide further insight. With Bitcoin currently trading at $105,767, just above the +0.5 sigma support level of $102,044, maintaining this position is paramount. A failure to hold above $102K could see Bitcoin retrace to its mean around $82,570. However, a sustained push upwards from $102K, particularly above the $106K mark, could justify Aguila’s strategy and pave the way for a retest of the +1.0 sigma range at $121,519, potentially leading to a new all-time high.

The next few days will be pivotal for Bitcoin. The current market dynamics, characterized by significant leverage and opposing forces, suggest that BTC’s next move will be decisive, either validating Aguila Trade’s conviction or delivering another sharp correction. All eyes are on the charts as the crypto world awaits the outcome of this epic Bitcoin tug-of-war.