- Bitcoin is showing strong bullish momentum as cooling U.S. inflation data boosts investor confidence and technical indicators point to sustained upward movement.

- While short-term dips remain possible, long-term signals suggest a potential rally toward the $200K mark.

Subtle Inflation Shift Sparks Big Bitcoin Hopes

Bitcoin bulls are back in charge as new inflation data hints at potential upside for the crypto giant. With the U.S. Consumer Price Index (CPI) rising just 0.1% in May—less than expected—market sentiment has turned increasingly optimistic, fueling speculation that Bitcoin could surge toward the elusive $200,000 mark.

The annual inflation rate now stands at 2.4%, and Core CPI, which excludes volatile food and energy prices, also rose just 0.1%. This came in below the forecasted 0.3%, marking the fourth straight month of cooler-than-expected inflation and offering a glimmer of economic stability amid persistent rate cut hesitations by the Federal Reserve.

Also read: Stablecoins Could Hit $2 Trillion by 2028, Says U.S. Treasury Secretary Scott Bessent

Technical Indicators Flash Bullish Signals

Bitcoin’s price action is aligning with this macroeconomic optimism. On the weekly chart, BTC remains well above both the 20- and 50-week moving averages, maintaining long-term bullish momentum. The On-Balance Volume (OBV) has moved past its December 2025 high, confirming increasing accumulation. Meanwhile, the Chaikin Money Flow (CMF) indicator above +0.05 reflects strong capital inflows—both classic signs of sustained investor confidence.

Additionally, the fair value gap (FVG) between $98K and $100.7K, which was tested earlier in June, acted as a solid demand zone, helping BTC bounce back.

Short-Term Danger Still Looms

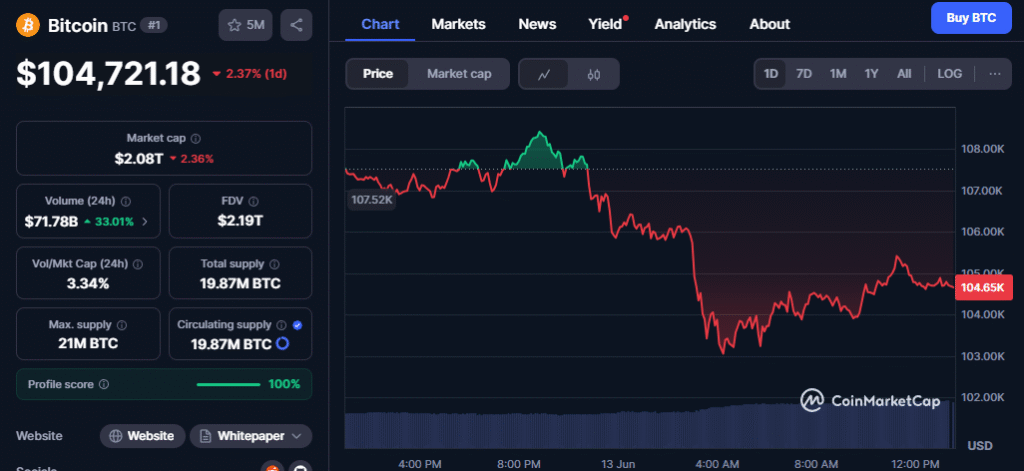

However, the daily chart presents a cautionary note. Bitcoin is hovering above another FVG between $106.5K and $108.3K. If the price closes a daily candle below $106.5K, this could spark a short-term dip toward the $100K–$102K region.

Despite that risk, strong demand and reduced profit-taking suggest holders are bracing for another leg up—possibly toward $200,000.

The Road to $200K Is Alive

Bitcoin appears poised for explosive growth as inflation cools and technical patterns align in its favor. While short-term volatility may test investor patience, the long-term structure remains bullish. With demand zones holding and capital flowing in, the $200K dream might not be so far-fetched after all.