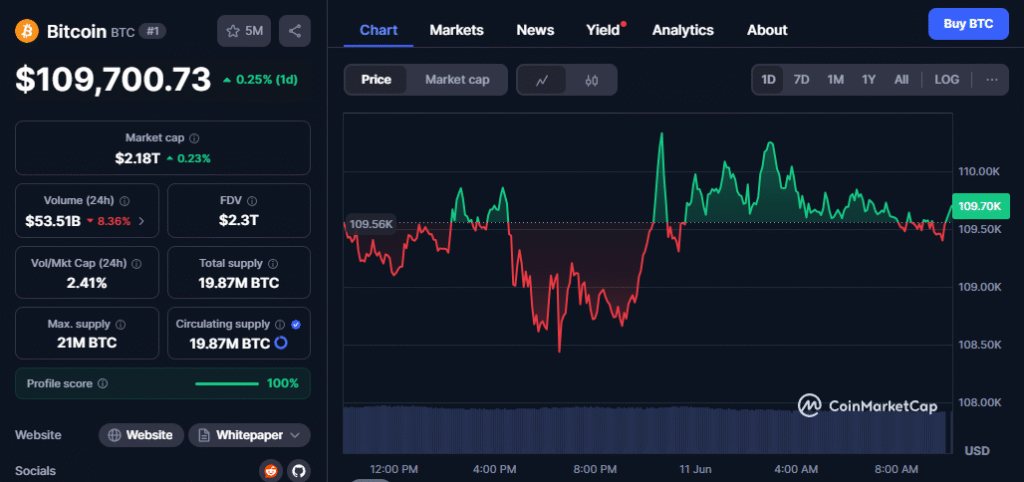

- Bitcoin has surged back above $108K, fueled by rising retail FOMO and aggressive whale activity, including high-leverage bets and large BTC transfers.

- However, with sentiment entering the greed zone and technical indicators flashing caution, a short-term correction may be on the horizon.

Retail Hype Returns as Bitcoin Rebounds Above $108K

Bitcoin [BTC] has made a powerful comeback, bouncing from a brief dip below $100K to break back above $108K. The bullish surge has reignited optimism across the crypto space — but is this real momentum or just another FOMO-fueled frenzy?

Retail traders are once again piling in, driven by fear of missing out (FOMO), while whale wallets make bold, high-leverage bets. However, warning signs are beginning to appear, raising questions about how long the rally can last.

FOMO Surges While Sentiment Enters the Greed Zone

According to Santiment, the latest price jump has triggered a sharp rise in trader sentiment, with the “greed” metric hitting its second-highest level in two weeks. This is a red flag for many seasoned investors, as the greed zone often precedes sharp corrections.

Retail optimism is back in full force after last week’s panic selling below $100K. The sudden mood reversal could be setting the stage for a classic contrarian scenario — where overly bullish sentiment precedes a market pullback.

Also read: Tron Price Forecast: TRX Breaks Resistance Amid Declining TVL, Eyes $0.32 Target

Whales Place High-Leverage Bets as Price Climbs

While retail traders chase the rally, whales appear to be making calculated moves behind the scenes. One notable whale recently opened a 20x leveraged long worth over $50 million at $106.5K — a bold play on Bitcoin’s ongoing momentum.

Additionally, nearly 1,000 BTC were transferred out of Kraken into unknown wallets, suggesting strategic accumulation by large players. These moves signal strong confidence from big-money investors — but they also hint that the stakes are rising quickly.

Technicals Show Strength, But Caution Is Warranted

Bitcoin’s RSI currently sits at 61.13, indicating bullish momentum without yet being overbought. However, the On-Balance Volume (OBV) is beginning to flatten around 1.74M, hinting that buying pressure may be losing steam.

Price action remains constructive above $108K, but the failure to hold above $110K could trigger a near-term pullback. For bulls to maintain control, sustained volume and continued whale support will be critical in the days ahead.

Bitcoin’s $108K breakout is a thrilling development, but with sentiment in the greed zone and technical divergence creeping in, traders should watch closely. Retail FOMO may be driving the surge — but history shows that hype alone rarely sustains the trend.